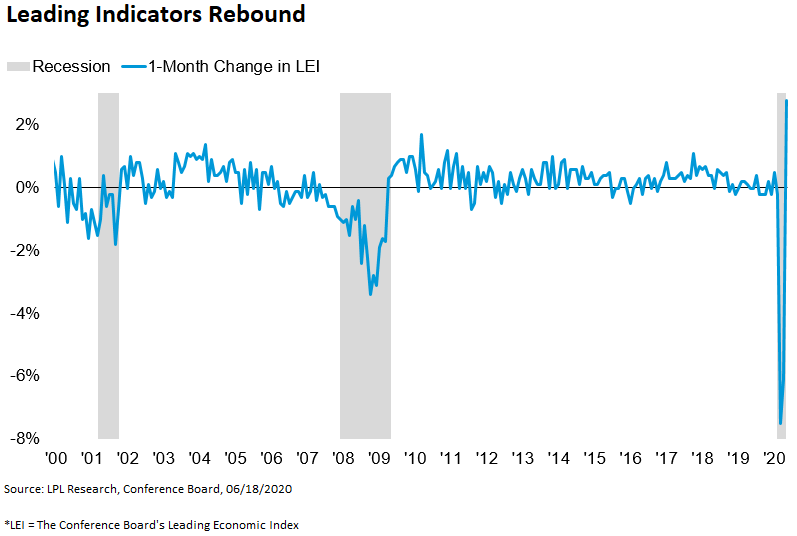

Yesterday, The Conference Board released last month’s reading for its Leading Economic Index (LEI), a composite of leading data series, which showed a month-over-month increase of 2.8%. As seen in the LPL Chart of the Day, the return to positive territory follows three straight months of negative monthly growth.

”We noted that the pace of the LEI’s deterioration slowed in the April report, potentially suggesting a bottom forming in the US economy,” said LPL Financial Senior Market Strategist Ryan Detrick. “Yesterday’s print was one of several positive economic data surprises we’ve observed recently, bolstering our optimistic view for economic growth in the second half of the year.”

While the economy still has a ways to go in order to recover from the damage of the prior three months, the composition of May’s LEI advance encourages us. We noted a disconnect in April’s readout in which the financial market indicators tended to be net positive contributors while the “real economy” indicators detracted. May’s release saw a reversal of that trend whereby the economic subindexes played catch-up. Seven of the 10 components were positive contributors led by an improvement in average weekly initial unemployment claims, average weekly manufacturing hours, and building permits. The three negative contributors were the Institute for Supply Management (ISM) New Orders Index, average consumer expectations for business conditions, and the Leading Credit Index.

The most recent LEI release reinforces our view that an economic bottom is likely behind us. Workers starting to return to jobs that they were unable to do remotely had material effects on May’s readout, and if that trend continues, a stock market trading at stretched valuations would have a stronger foundation under it.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

The Leading Economic Index is a monthly publication from the Conference Board that attempts to predict future movements in the economy based on a composite of 10 economic indicators whose changes tend to precede changes in the overall economy.

All index and market data from Factset and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05024263