Schedule a Financial Consultation

Power of attorney is an essential legal document in every estate planning portfolio. Through power of attorney, you authorize a designated person to act on your behalf to manage your affairs, whether business, medical, financial, or private. At Hollander Lone Maxbauer, we support our clients through any financial questions and concerns they may have when determining the contents of their power of attorney.

Different Types of Power of Attorney

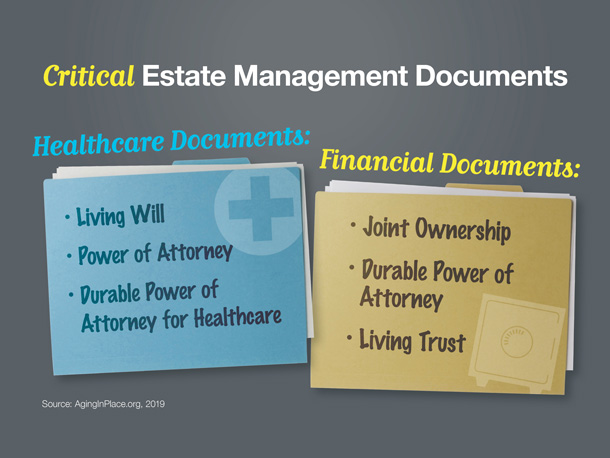

There are several types of power of attorney. Each document is designed to delegate power over your affairs to a specific agent, but each document also contains unique characteristics that may or may not suit your financial needs. It’s important to discuss the types of power of attorney with your financial advisor and estate lawyer to select the document that is best for your assets.

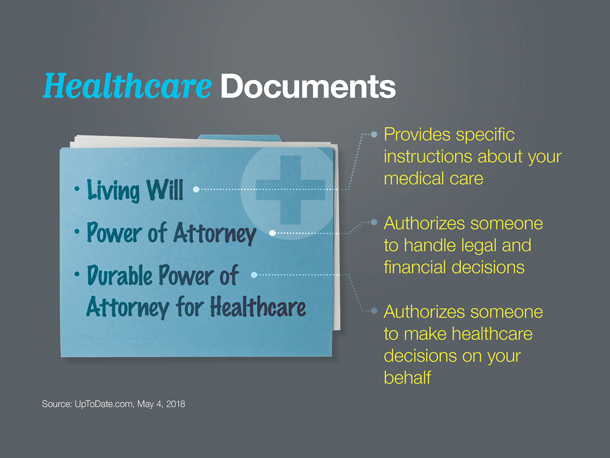

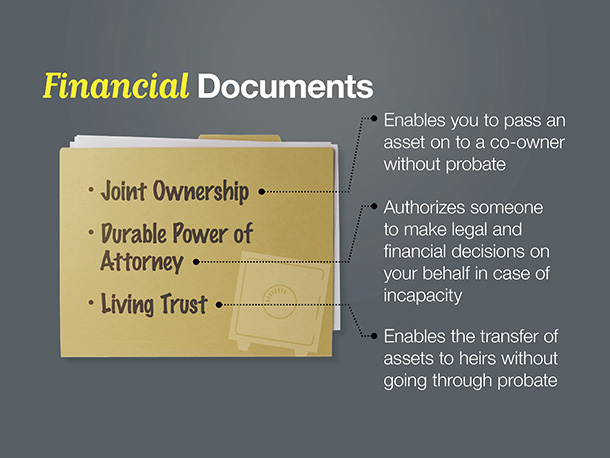

- Durable power of attorney: Elect a person to make financial-related decisions on your behalf should you become incapacitated and unable to act yourself.

- Non-durable power of attorney: Gives permission to a financial advisor or agent to manage a one-time task or activity for a limited time on your behalf, often to achieve a specific financial goal.

- Limited power of attorney: Identifies a person to represent you in financial matters. Also known as a financial power of attorney.

- General power of attorney: Designates one person to make financial, business, health, and legal decisions, with limitations.

- Medical power of attorney: Identifies one person to make medical decisions on your behalf when you cannot, regarding surgery, medical treatment, and end-of-life care.

When Power of Attorney Takes Effect and When It Stops

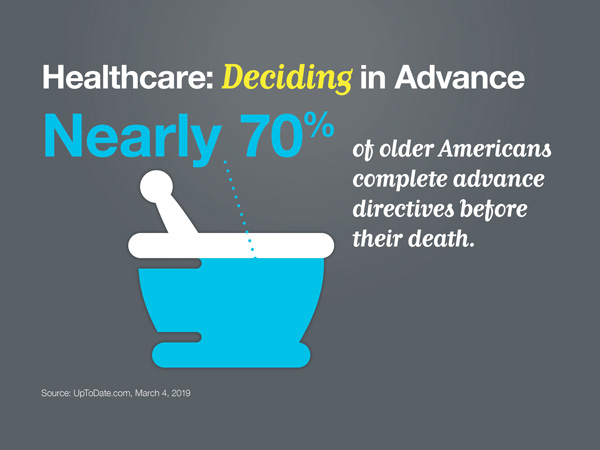

The existence of a power of attorney, in any of its forms, does not automatically mean the named agent can act on your behalf right away. The documentation specifies when decisions can be made, whether immediately or when you are incapacitated. This information is critical to protect your assets, health, business holdings, lifestyle, and more.

A power of attorney becomes null and void upon a person’s death and the acting representative no longer has the authority to make decisions for the decease or their estate.

Select an Agent for Power of Attorney

The behavior of your designated agent in your power of attorney can dramatically affect your financial future for good or bad. No one likes to think of themselves as being incapacitated or unable to manage their life and finances in their own way, but life happens. Accidents, illness, and injury can impact consciousness and decision-making ability, sometimes when big financial matters must be addressed.

Often, people lean toward selecting a family member to act on their behalf in financial documents or power of attorney. Discuss this critical choice with your attorney and representatives, whether spouse, children, or otherwise. It may even be necessary to name a hierarchy of agents so there is always someone available to act.

Above all, choose someone you trust to manage your finances should a time arise when you cannot make the big decisions.

The Financial Aspects of Power of Attorney

You manage your own finances, every aspect of them. When you work with a financial advisor, the financial decisions made are all yours, but every conversation is important. A financial expert offers guidance, suggestions, recommendations, and advice so you have the information to make the best money choices for the present and future, but you make the moves that are best for you.

Find out how your power of attorney and financial management blend together to be a powerful part of your estate planning and financial portfolios. Contact Hollander Lone Maxbauer to schedule a consultation and discuss your circumstances.

The Hollander Lone Maxbauer Article Center

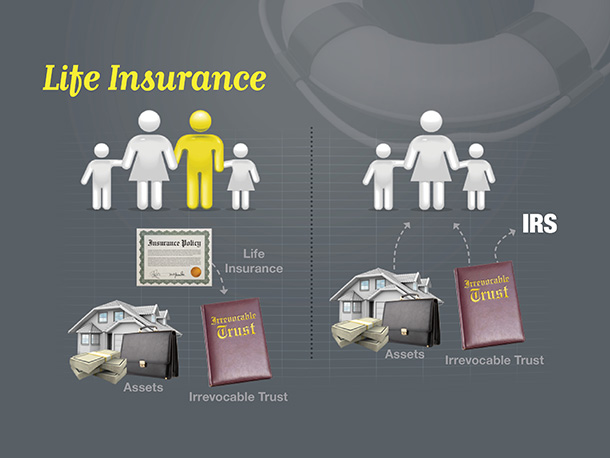

How Much Life Insurance Do You Need?

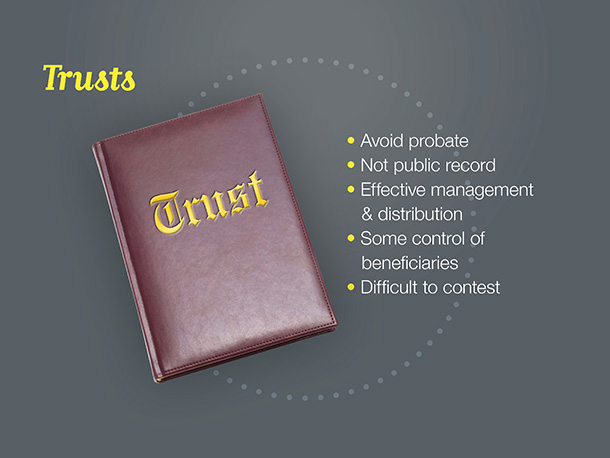

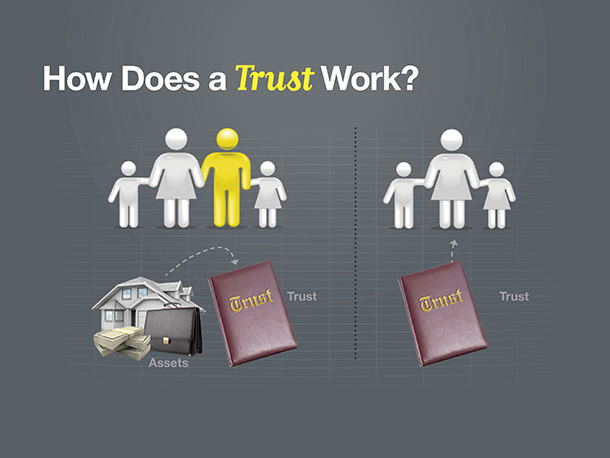

Using Trusts to Manage Wealth: What Investors Should Know

Most Common Estate Planning Missteps

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Estate Matters: Principles of Preserving Wealth