Schedule a Financial Consultation

Retirement is a time to rest, be with family, travel, and enjoy the fruits of your labor. If you follow essential steps for retirement planning, you’ll never worry about finances and feel confident about having everything you need to support yourself well into your golden years. Work with the retirement experts at Hollander Lone Maxbauer to create a customized financial plan for when you say goodbye to work and hello to the rest of your life.

Itemize Anticipated Expenses

Peace of mind in retirement starts by identifying anticipated monthly and annual expenses, both non-discretionary and discretionary. These can include:

- Mortgage and home maintenance

- Property and income taxes

- Utilities, from electricity to cable to water

- All car expenses, from payments to fuel to maintenance

- Health insurance

- Food and dining out

- Entertainment

- Gifts

- Travel

- Charitable contributions

Regular obligations add up, and they can feel different when you’re retired than when you were bringing home a paycheck every two weeks. It’s a relief to know you have resources earmarked to manage ongoing needs no matter the circumstances.

Be Honest About Your Lifestyle

You can’t underestimate the costs of your lifestyle when you are conducting retirement planning. Do you still have children at home and college tuition to pay? Do you plan to downsize or add a second home to your portfolio?

Be honest with your financial planner about your retirement hopes and dreams and then have a frank discussion about what’s viable, what’s not, and what might take some fancy financial footwork to achieve given your obligations and income.

Inflation is also an essential matter to consider. When prices go up, everyday living expenses do too. If this change occurs faster than investment returns can deliver, or beyond what retirement income allows, the allocation for your retirement income will be impacted. One of the essential steps for retirement planning is anticipating the best and the worst and managing finances accordingly.

Identify Multiple Retirement Income Sources

Establishing income sources in retirement includes setting a budget, understanding all expenses – regular, annual, and unexpected – and knowing how to access different income sources as needed, from Social Security to an IRA, without excessive tax consequences. Talking strategy with your financial planner is the smart step to financial comfort in retirement.

- Nest egg: Your financial advisor will guide you in how to set aside a few years’ worth of liquid assets for expenses and emergencies. Nest egg accessibility is the most important part of this equation – you need to be able to get your hands on cash immediately for whatever reason.

- Investments: Income-producing, low-risk investments should include at least a decade’s worth of expenses in bonds, annuities, rental properties, and the like. The income that comes from these investments will help fund the nest egg.

- Growth: Growth-focused assets also fund the nest egg as stocks, businesses, private equity, and more appreciate. Their existence also helps counteract inflation.

What Will You Do with Your Free Time?

Many retirees find themselves getting a part-time job, consulting, or investing in a business to keep themselves engaged. Some of these choices mean income – but how long will you do this kind of work? What is your goal for taking part in these activities? How will this affect your finances?

Your retirement planning specialist will talk to you about where you see that income going, if it will be part of your monthly or annual money plans or if it will be an extra resource that you invest or save.

No matter where you stand when it comes to retirement – whether it’s five years or five months away – it’s always a good time to plan. Get the financial support you need from Hollander Lone Maxbauer. Contact us to schedule a consultation.

The Hollander Lone Maxbauer Article Center

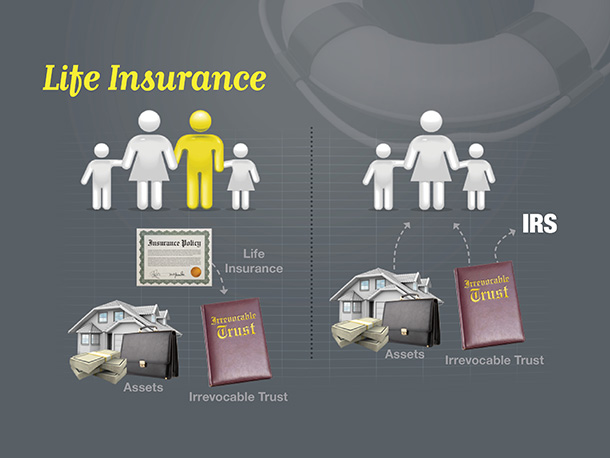

How Much Life Insurance Do You Need?

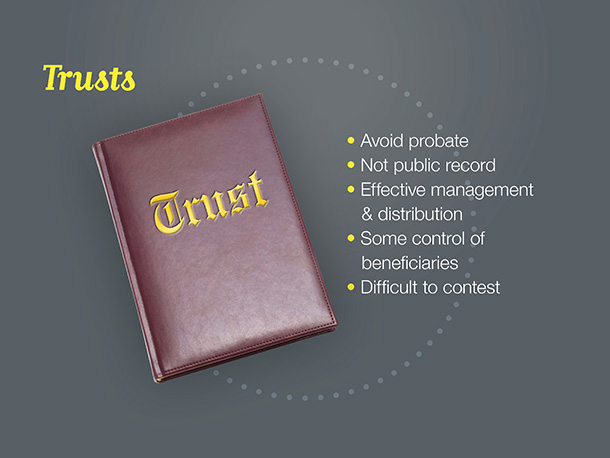

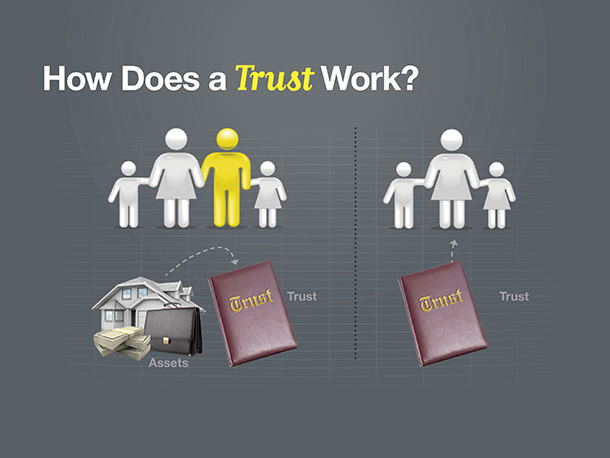

Using Trusts to Manage Wealth: What Investors Should Know

Most Common Estate Planning Missteps

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Estate Matters: Principles of Preserving Wealth