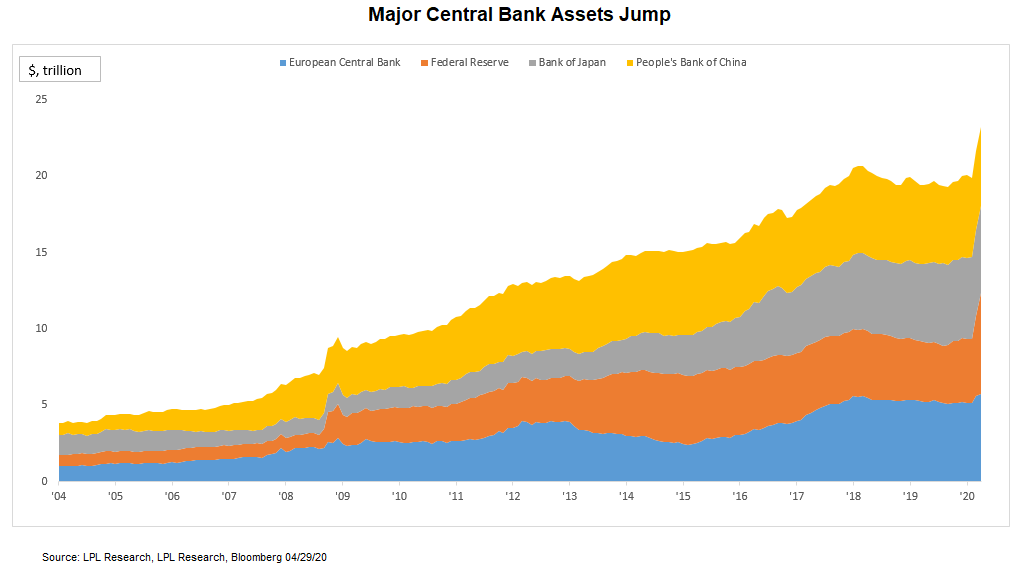

The Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BOJ) all met in the last week and while the show of power was minimal compared to recent weeks, they collectively reasserted their resolve to do whatever is necessary to support the global economy through the COVID-19 economic crisis. Rates are being held about as low as they can go, significant new programs to enhance market liquidity and support lending are in place, and, as shown in the LPL Chart of the Day, asset purchases have accelerated. In fact, with April not yet completed, central bank assets have risen over $3 trillion, the biggest two-month jump on record.

“The central bank response to COVID-19 has been fast, effective, and built to impress,” said LPL Financial Senior Market Strategist Ryan Detrick. “And the market is seeing it. It’s no coincidence that the market bottomed the day after the Fed rolled out a wide range of new programs addressing key areas of market and economic disruption.”

Overview of Recent Central Bank Activity

The Fed concluded its most recent two-day meeting on Wednesday, April 29. Prior to the meeting the Fed had expanded its program supporting municipalities by lowering the minimum size of the city or county to qualify. The Fed left its target rate unchanged at 0 – 0.25%. Through its policy statement and Fed Chair Jerome Powell’s comments, the Fed signaled that it is unlikely to remove its extraordinary policy support anytime soon, and we believe the Fed may hold its policy rate near zero into 2022. Asset purchases are currently open-ended and have expanded to include investment-grade and high-yield corporate exchange-traded funds.

The BOJ met on Monday, April 27 and announced that it would lift its cap on buying government bonds, making purchases open ended, and triple the size of its corporate bond commercial debt purchases.

The ECB met on Thursday, April 30 and announced new refinancing operations and that it would ease conditions on long-term loans to banks, encouraging banks to increase lending.

With interest rates near zero, all major central banks have been expanding their economic support through new programs and increased asset purchases. Central bank are showing that in a time of crisis, their policy response is not limited to setting policy rates or even bond purchases. The expanded activity has all but eliminated the idea that the central banks are out of ammunition, both now and looking forward. There will come a time when these programs will end, balance sheets will unwind, and rates will rise. But until that time, central banks have shown that even prudent support in a time of economic distress is only limited by their imagination, keeping the old investing maxim “Don’t fight the Fed” alive even in an age of zero rates.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05005056