A late month selloff in January saw the S&P 500 Index close marginally lower for the month. But stocks have taken off in February, with the S&P 500 up nearly 4% this month, as US economic data remains strong and fears over the worst-case scenarios for the coronavirus appear overblown.

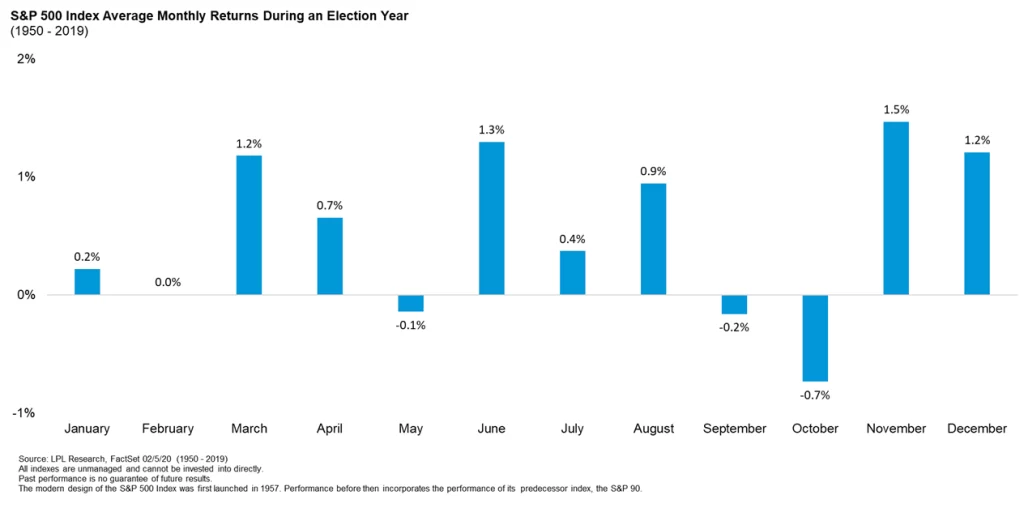

Historically, February has been a month when stocks tend to take a bit of a break. As shown in the LPL Chart of the Day, the S&P 500 has been flat, on average, during the second month of an election year. What is most interesting, though, is how weak October has been historically leading up to presidential elections, yet how strong stocks have been in November and December as political uncertainty clears following elections.

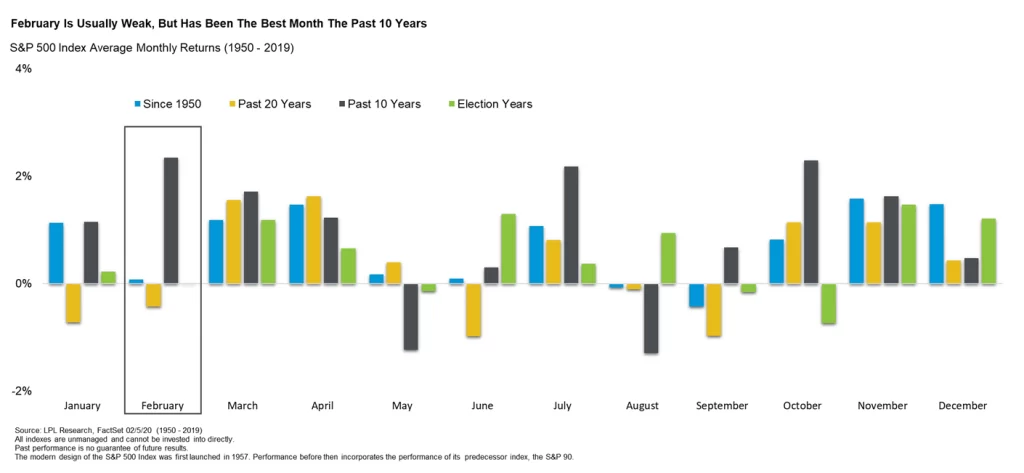

Maybe the big gains so far this month shouldn’t be a total surprise? “Yes, February historically has been a troublesome month for stocks,” said LPL Financial Senior Market Strategist Ryan Detrick. “Yet over the past decade, no month has seen better returns.” In fact, the S&P 500 has gained 2.34% on average in February over the past decade, compared with the second best month of October’s gain of 2.29%.

For more of our investment insights and thoughts on the economy and the coronavirus, check out our latest Market Signals podcast.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

For Public Use – Tracking # 1-950501