2020 was a good year for stock investors despite unprecedented challenges.

After being down more than 30% at the March 2020 lows, the S&P 500 Index ended the year with a solid 18.4% total return. Last year marked the first time the index ended a year positive after being down at least 30% during that year. Gains were driven primarily by the emerging economic recovery taking hold, bolstered by massive stimulus, and the remarkably fast COVID-19 vaccine development that encouraged market participants to begin to price in the end of the pandemic.

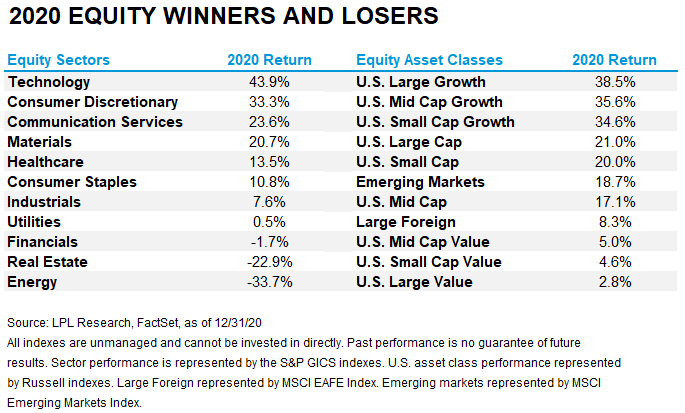

We take a look at some of the asset class and sector winners and losers in 2020.

Massive growth outperformance. The growth style of investing had one of its biggest runs ever relative to the value style in 2020, benefiting from better positioning for the pandemic, superior earnings growth, and balance sheet strength. As shown in the LPL Chart of the Day, the major growth indexes returned over 30% while the value indexes produced mid-single-digit gains. The technology sector was the biggest driver of growth outperformance (about 60% of it), but the consumer discretionary sector—led by Amazon, one of the biggest stay-at-home stocks—also outperformed the broad markets and value indexes by a wide margin last year.

“We maintain a slight preference for growth but have become more interested in value stocks as the outlook for economic growth has improved,” said LPL Financial Equity Strategist Jeffrey Buchbinder. “The additional fiscal spending we may get from the Democratic-controlled Congress adds to the case for value by boosting interest rates and supporting financials.”

Technology topped all sectors. Technology led all S&P 500 sectors in 2020 by a wide margin with its nearly 44% return. Remove the sector away from the S&P 500 performance, and last year’s 18.4% gain would drop to around 6%. Of course, the work-from-home, stay-at-home environment provided a big boost for the sector last year. But we continue to like the sector’s prospects given the solid earnings outlook and powerful secular tailwinds such as 5G, cloud computing, mobile payments, and artificial intelligence.

Small cap comeback. When the United States entered a recession and stocks plummeted in March 2020, it was no surprise that small caps underperformed. They are generally more economically sensitive, domestic by nature, and are less able to withstand economic and market stress than larger cap companies. But small caps stormed back as confidence in the economic recovery increased, including the Russell 2000 Index’s best quarter ever in Q4 (+29.3%). Small caps actually slightly outpaced the large cap S&P 500 Index for the year. We upgraded our small cap view in September because they tend to do well early in economic cycles, and we expect solid gains for small caps again in 2021 as the recovery gains steam.

Rough year for energy. Energy was the biggest loser in 2020, with a decline of more than 30%, more than 10 percentage points worse than the next worst sector—real estate. You probably don’t need to look any further than the 20% decline in crude oil prices to explain the weakness, but sensitivity to travel added to the sector’s woes. Crude’s rally back to pre-pandemic price levels in the $50 per barrel range and related improvement in sector performance are encouraging, but we’re staying cautious for now.

Developed international. Developed international stocks lagged in 2020, based on the MSCI EAFE Index, due mostly to weakness in France, Japan, and the United Kingdom (UK). These countries lack the technology exposure that the US indexes enjoy, and therefore, their markets were hit harder by the pandemic. Meanwhile, the Brexit drama added to the UK’s challenges. Emerging markets fared much better than developed international markets, roughly matching gains for the US indexes thanks to strength in China, which led the world out of the global pandemic, as well as South Korea and Taiwan.

Be on the lookout for our updated views on the major equity asset classes and sectors in our next Global Portfolio Strategy report due out on January 12. And for more of our latest thoughts on 2020 and where stocks may be headed in 2021, please watch our latest LPLResearch Market Signals podcast below.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05096658