The recession appears to be behind us in the United States, and the early stages of an economic expansion have been taking shape. There is a growing debate over whether an expanding economy, in conjunction with historic fiscal and monetary policies, may cause inflation to overheat. This begs the question, will we see a reflationary environment—where prices will merely normalize to prior levels—or outright inflation—where consumer prices begin to increase above trend?

Thursday’s consumer price index (CPI) release may have put some of those concerns about inflation to rest—at least for now. US CPI rose 0.3% month over month in January, where rising gasoline prices accounted for the bulk of the increase in the headline index. Core CPI (which excludes volatile food and energy prices), was flat on a month-over-month basis.

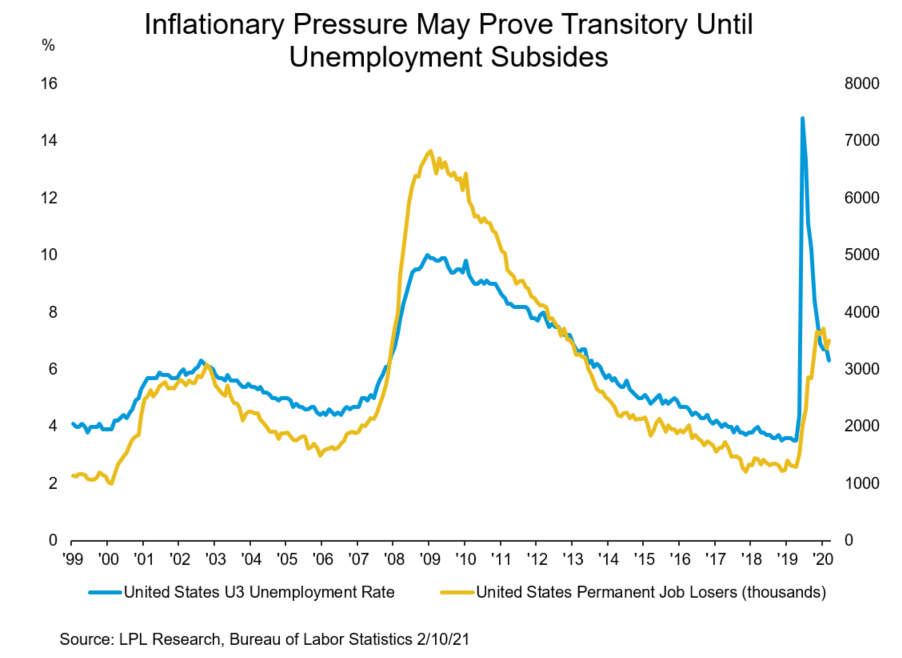

Broadly, we think inflation jitters are overblown at the present juncture, as slack in the labor market continues to present a headwind for persistent inflation. The Philips curve, a measure of the relationship between the unemployment rate and inflation, has flattened over time, suggesting that the US economy is able to stomach lower levels of unemployment before the labor market causes inflation to heat up—for example, the environment we saw in 2019 when the unemployment rate crossed below 4% without triggering inflation.

As shown in the LPL Research Chart of the Day, the unemployment rate remains quite high at 6.3%, while the number of permanent job losers (those looking for work whose employment ended involuntarily), remains near its pandemic highs:

However, while inflation may be low right now, as we enter the spring, base effects from the deflationary environment seen last year will “inflate” the year-over-year CPI numbers over the next few months.

“It’s reasonable for the market to expect inflation to rise from depressed levels, but we’re not expecting inflation to get out of hand,” added LPL Chief Market Strategist Ryan Detrick. “We think we’re more likely to see more of a reflationary environment rather than a truly inflationary environment here in 2021.”

Further stoking the debate about inflation, Congress is in the midst of debating additional fiscal stimulus with an expected price tag north of $1 trillion that it intends to pass before enhanced unemployment benefits expire on March 14. Meanwhile, Federal Reserve (Fed) Chair Jerome Powell has continued to reiterate the Fed’s stance that it is not even thinking about thinking about raising rates, and it does not intend to begin tapering its asset purchase programs in the near term, either. After the stubbornly low inflation environment seen after the 2008-09 recession, the Fed has made it abundantly clear that it is willing to look past any transitory inflationary forces in an almost “prove it” mentality for steady inflation above its 2% average target as the Fed emphasizes full employment.

At the same time, there are market dynamics pointing to rising inflation expectations, including:

- 10-year breakeven inflation expectations [the yield difference between Treasury inflation protected securities (TIPS) and nominal Treasury yields] have risen to the highest level since 2014

- Commodity prices, including WTI crude oil, lumber, and copper, have been climbing

- Banks and other cyclical sectors have been outperforming so far in 2021

- Sovereign bond yields have been rising globally

So who will blink first? Only time will tell, but we think any calls for runaway inflation are getting ahead of themselves.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05110645