The Federal Reserve (Fed) demonstrated Wednesday in its final policy meeting of the year—again—that it has not exhausted the tools it has for supporting the economy and still holds plenty in reserve. The Fed kept its target policy rate at 0–0.25% but sharpened its guidance on how long it would continue its bond purchase program, also known as quantitative easing (QE), at its current level. QE strengthens the Fed’s ability to influence longer-term rates. Market participants were skeptical at first that the new guidance was meaningful, but Fed Chair Jerome Powell made a strong case in his press conference that the change was substantive.

“Jerome Powell has become an increasingly effective communicator during his term leading the Fed, and the skills were on display Wednesday,” said LPL Chief Market Strategist Ryan Detrick. “He turned the market’s perception of a tepid micro-easing into the rollout of a new policy tool.”

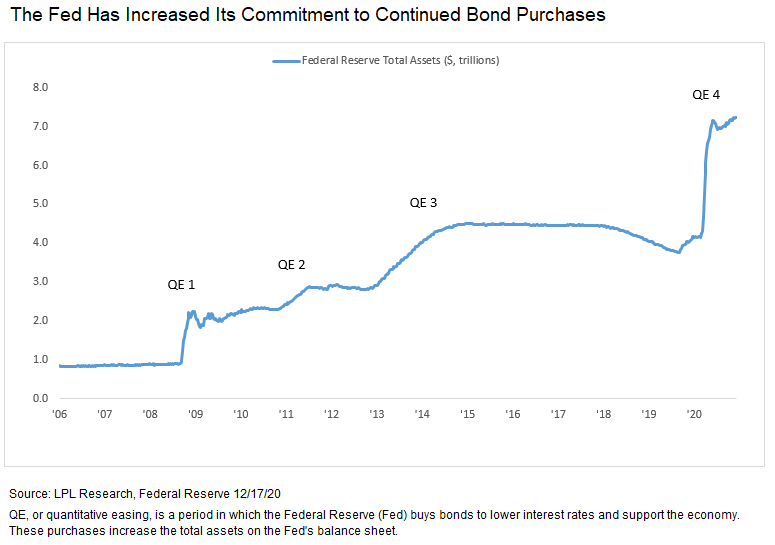

The Fed is currently purchasing $120 billion of Treasuries and mortgage-backed securities each month, expanding its balance sheet dramatically, as shown in today’s LPL Chart of the Day. While the Fed has a strong influence on short-term market rates via its policy rate, it has much less influence on longer-term rates. In addition to increasing the amount of cash in the financial system to help ensure that it runs smoothly, the purchases soak up some of the supply of bonds, keeping prices for longer maturity bonds a little higher and rates a little lower.

Many market participants were looking for the Fed to move toward buying longer-maturity bonds or increasing its purchases, both moves that would have increased its influence on longer-term rates. Powell noted during his press conference that both of those actions were still on the table if needed. But he also emphasized that the change the Fed did make was meaningful and loosely parallel to the updated policy framework it had rolled out earlier this year that allows inflation to run a little higher before the Fed raises rates.

The Fed’s focus on greater clarity around the timeline of its bond purchases makes sense. In the years following the Great Recession, the Fed ended its bond purchase program twice, only to have to restart it as the economy stumbled. It was more patient during the third round of purchases and was also more careful when communicating how it would wind it down, while also tapering bond purchases gradually. The Fed is building on those lessons.

Are there risks to the Fed’s new policies? In time, yes. The low-rate environment the Fed has created increases borrowing, hurts savers, and may contribute to asset bubbles. It may also contribute to long-term risks from inflation. Those are all genuine concerns. But for now, the Fed’s ability to demonstrate a steadfast commitment to supporting the economy and taking action to make that happen are more important.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05090770