Schedule a Financial Consultation

A healthcare directive, also known as an advance medical directive, is an essential component of estate planning. The financial experts at Hollander Lone Maxbauer in Southfield, MI, consult with clients throughout the estate planning process to ensure that current financial standing and future financial goals are earmarked appropriately and in accordance with the wishes of your healthcare directive.

What is a Healthcare Directive?

A healthcare directive addresses a person’s medical care at the end of their life. This document identifies how you want your last wishes to be carried out when you cannot make those requests yourself because of incapacitation or illness.

The end-of-life wishes that are put in writing can include:

- DNR: Your do-not-resuscitate preference should life support be in question.

- Organ donation: How you prefer your organs to be treated after death.

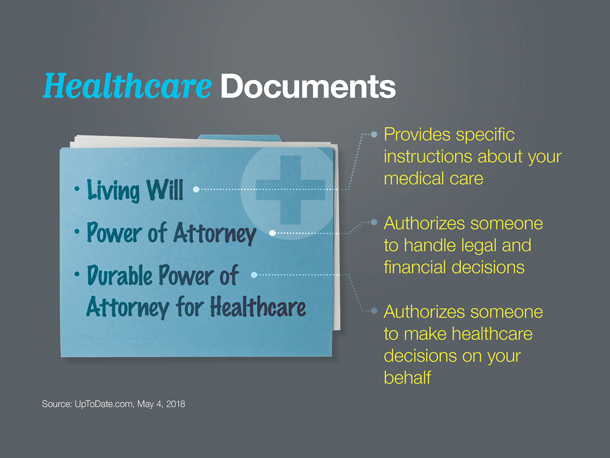

- Medical power of attorney: The designation of a representative to make major medical decisions when you cannot do so yourself, usually because of a permanent vegetative state or terminal diagnosis.

- Designated loved one: Name a specific loved one to make medical decisions for you when you cannot.

Living Will vs. a Healthcare Directive

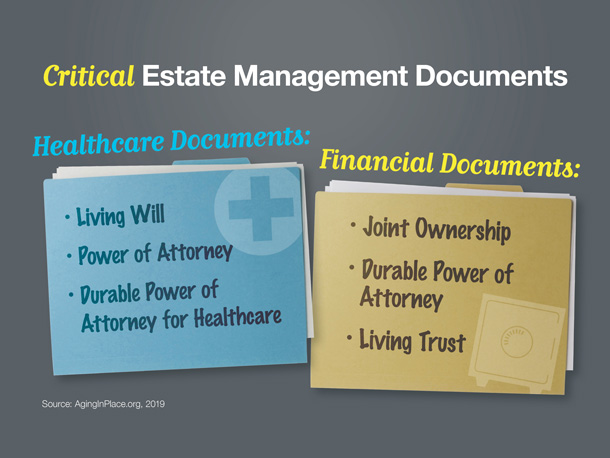

Living wills are typically considered part of the same category as a healthcare directive. A living will is often referred to as an advance directive, but not all advance medical directives or healthcare directives are categorized as living wills.

Typically, a living will is maintained along with a last will and testament. The type of document that is best for your financial circumstances should be discussed with your financial advisor to ensure that your wishes are honored at the end of your life and carefully curated to respect your financial goals and bequests.

How a Healthcare Directive Impacts Financial Wellness

It is easy to assume that your health and wellness and end-of-life wishes don’t have much to do with your wealth profile, but consider the following elements that can eat into your finances and affect the assets you have identified for your loved ones:

- Long-term care costs

- Healthcare costs in a vegetative state

- Hospice care costs

- Palliative care costs

- Costs of funeral services

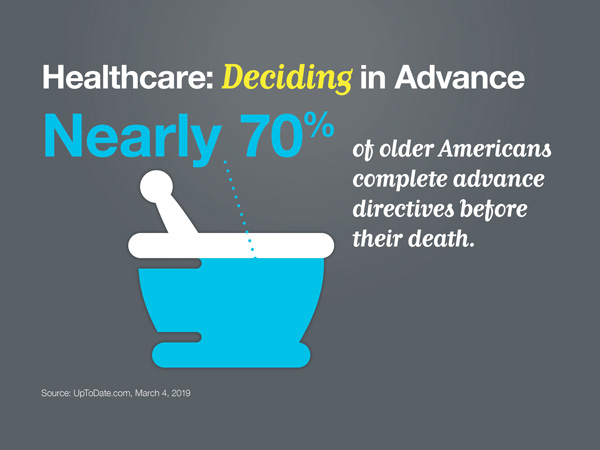

How long a person lives in a compromised state before they pass away absolutely impacts financial standing. Now is when you get to decide how your savings will be parceled out and identify when and how it happens. If you do not want the bulk of your life’s earnings and savings to go toward medical care at the end of your life, a carefully worded healthcare directive will ensure that your preferences are honored in writing. You have the power now to determine how much healthcare you wish to receive at the end of your life, what state you need to be in before major life or death decisions are made, and who will maintain the sole right to carry out these wishes.

Hollander Lone Maxbauer and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Get Healthcare Directive Support from Your Financial Advisor

A healthcare directive is an essential document for every adult to have as part of their estate plan. If you have a complex web of assets, investments, multiple homes, multiple marriages, or a large family, identifying your wishes legally is necessary. At the time of death, it’s important for major money and healthcare decisions to have already been made.

Get the support you need when managing these difficult choices through Hollander Lone Maxbauer. Make the right moves for your estate to protect your assets and beneficiaries. Contact us to schedule a consultation.

The Hollander Lone Maxbauer Article Center

How Much Life Insurance Do You Need?

Using Trusts to Manage Wealth: What Investors Should Know

Most Common Estate Planning Missteps

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Estate Matters: Principles of Preserving Wealth