Schedule a Financial Consultation

A person’s last will and testament is the foundation of estate planning materials. Because this important document involves end-of-life financial decisions, it makes sense to discuss it with your financial advisor at Hollander Lone Maxbauer in Southfield, MI. Expand your knowledge so you can make educated decisions about how assets should be managed after your death.

The Details of a Last Will and Testament

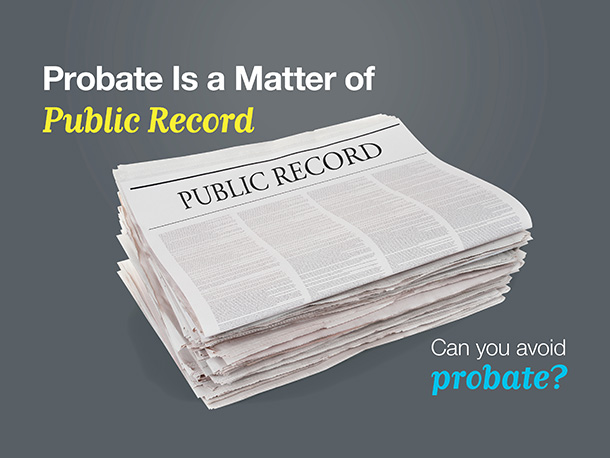

A last will and testament directs the settlement of a person’s estate and provides for the distribution of assets according to your wishes. Without a will, state laws determine estate distribution through a process known as probate. To avoid this unwanted situation, the most common details in a will often include:

- Names of heirs

- Name of a trustee for assets

- Appointment of a guardian for minor children

- Identification of the executor of the will

- Specific bequests

Many people have a living will drawn up alongside their last will and testament to secure their family’s future. This document also includes customized language that ensures assets are legally distributed per your instructions and all other requests are honored too.

Making Decisions for the Future

Though it can feel daunting to approach the idea of the end of your life, addressing this inevitability now means your loved ones are taken care of according to your requests. You are preparing for the future even though you will no longer be in it, but your assets and wishes will be with a last will and testament.

- Make decisions: Identify exactly how your assets will be managed and distributed after death.

- Be specific: A will can be complex or simple, as long as this document exists and your preferences are legally noted.

- Avoid probate: Having a will does not mean that loved ones can avoid probate courts, but with a will in existence it makes dealing with probate much easier and less costly.

- Get what you want: Probate has hard and fast rules, and if you die without a last will and testament, your assets and property will be distributed according to Michigan laws that will not necessarily reflect your preferences.

The Addition of a Living Trust or Living Will

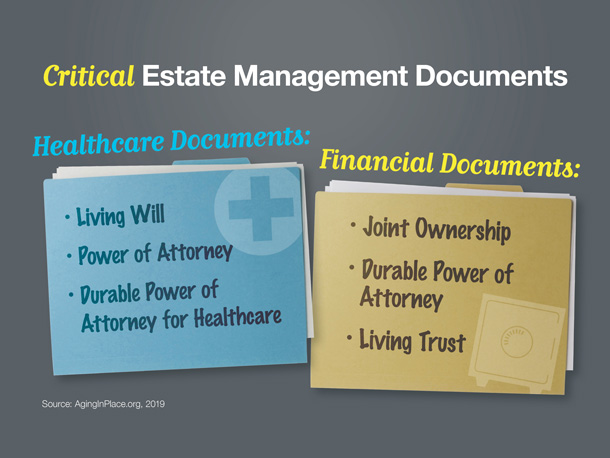

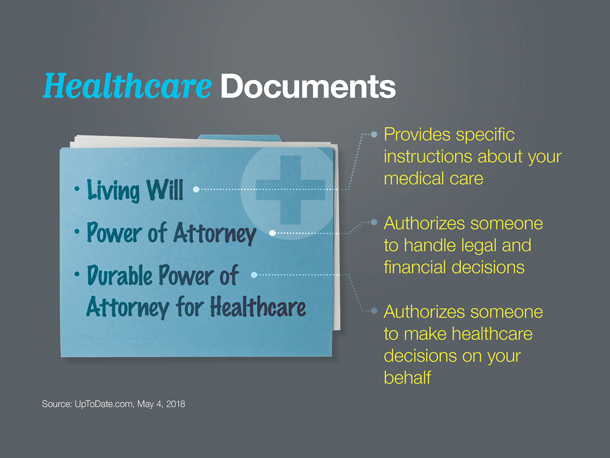

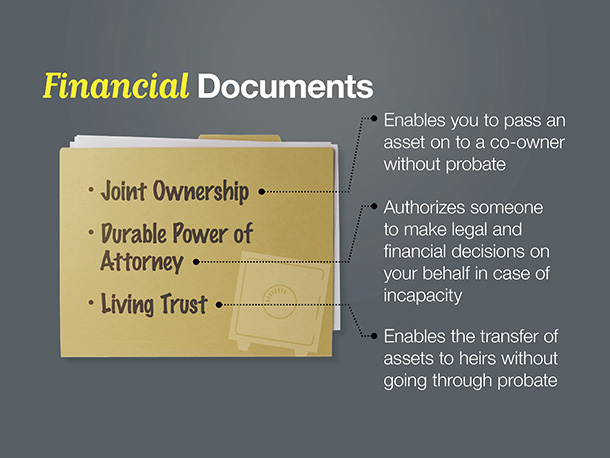

It is common to have other documents drawn up alongside a last will and testament, including a durable power of attorney and advance medical directive. The following two documents are also important additions:

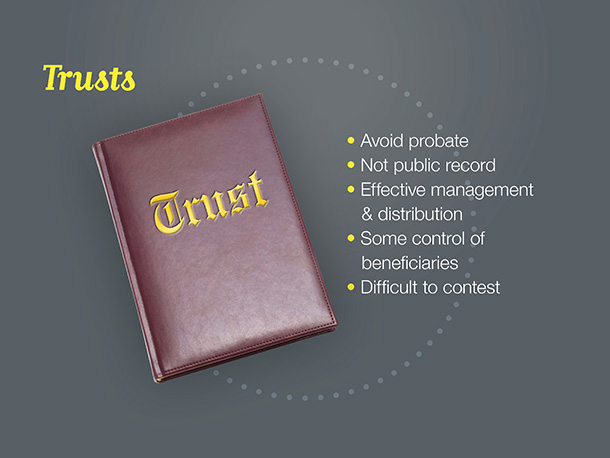

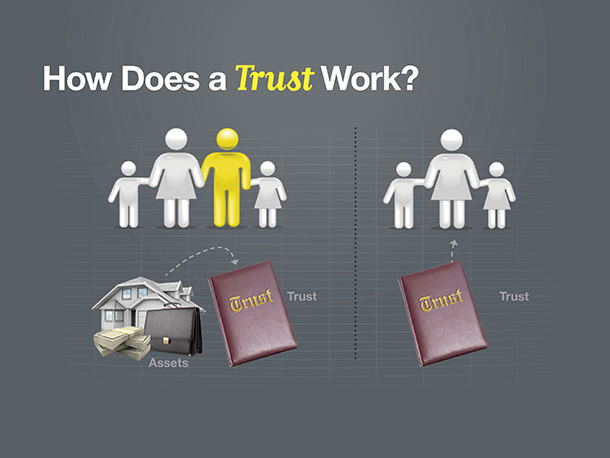

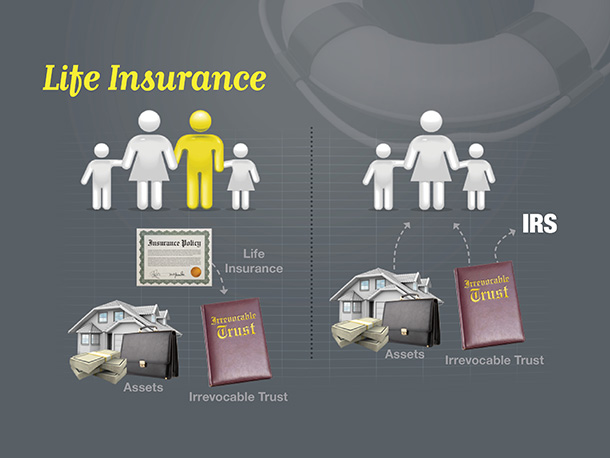

- Living trust: A living trust is a legal document funded with specific assets that are earmarked to pass to designated heirs outside of probate. It allows a person to manage their estate while they’re alive and transfer it to heirs after death.

- Living will: This written, legal document is part of an advanced direction that states a person’s specific wishes regarding end-of-life care and any medical treatments you would or would not want used to keep you alive, such as a do-not-resuscitate (DNR) order, feeding tube, life-prolonging procedures, and ventilators. A living will allows a loved one to make medical decisions on your behalf.

Hollander Lone Maxbauer and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Financial Support for Your Last Will and Testament

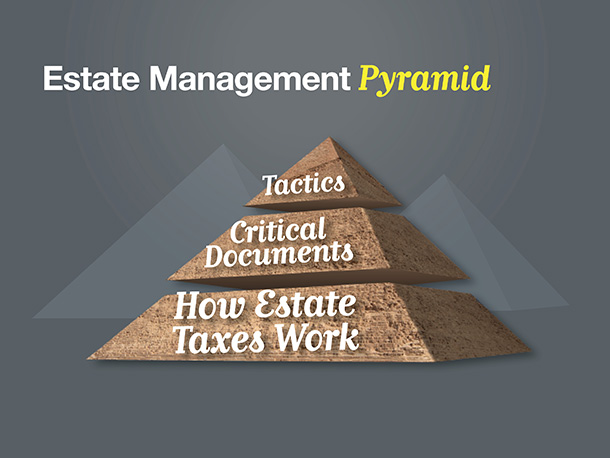

Along with the last will and testament, estate planning essentials can also include power of attorney, medical power of attorney, revocable trust, and a healthcare directive. These documents are essential to ease your mind about how wealth distribution and wishes will be carried out after your death to protect your family.

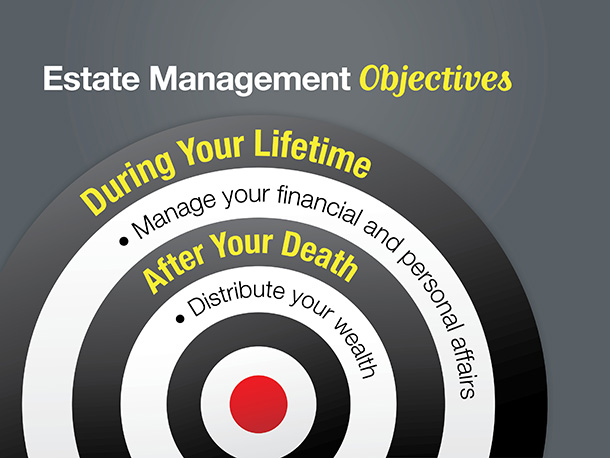

When your estate is managed effectively with support from a financial advisor, you can feel confident about managing your affairs yourself during your lifetime. Learn more from Hollander Lone Maxbauer about ensuring that your last wishes are honored, respected, and carried out as you wish.

The Hollander Lone Maxbauer Article Center

How Much Life Insurance Do You Need?

Using Trusts to Manage Wealth: What Investors Should Know

Most Common Estate Planning Missteps

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Estate Matters: Principles of Preserving Wealth