Schedule a Financial Consultation

A living trust is an estate planning tool established during a person’s lifetime that holds and protects their assets while still allowing use of the assets. The trust also directs the distribution of the assets to designated beneficiaries after a person’s death. The financial advisors at Hollander Lone and Maxbauer in Southfield, MI, aid clients in working out their living trusts through a careful review of current and future financial standing and goals.

Assets That Can and Cannot Be Included in Living Trusts

Some individuals prefer the idea of a living trust to a last will and testament because the former document bypasses the probate process. Many people, though pursue a living trust so they can have a voice in the transfer of chosen assets to chosen beneficiaries after their death.

Certain assets cannot be placed in a trust and must be dealt with in different ways, including:

- Retirement assets (IRAs, 401ks, etc.)

- Health savings account (HSA) balances

- Motor vehicles

- Foreign investments

Everyone’s financial circumstances are different, and not everyone will be interested in living trusts. While nearly everyone should have a will, anyone with assets over $100,000, minor children, and concerns about the difficulty of probate, a trust can serve a valuable role.

Assets that can be placed in a living trust include:

- Real estate (land and homes)

- Jewelry

- Artwork or antiques

- Business interests

- Financial accounts

- Other personal property

Benefits of a Revocable Living Trust

A living trust can be either revocable or irrevocable, which affects the flexibility of the document and how its distribution of assets are taxed. A living trust is commonly known as a revocable living trust or a revocable trust and is the most common incarnation of this document.

There are many benefits to holding a revocable living trust. This estate planning tool can help individuals and their families:

- Avoid probate: A trust can minimize or prevent a lengthy, complex, and sometimes costly probate process. Probate is one of the main reasons people add a living trust to their estate plan.

- Rely on a trustee: This legal document names a trustee whose role begins upon the death of the holder of the trust. The trustee controls the assets in the trust, distributes assets as directed, and manages assets according to a beneficiary’s best interests.

- Immediate distribution of assets: With a trust, assets are immediately accessible to beneficiaries because they are held by the trust and not your estate so the probate process is avoided.

- Maintain control: Assets remain in your control and provide you with the power to change beneficiaries at any time. For example, you can opt to set up a trust within a trust for a minor beneficiary (say, a new grandchild) after the original document is created and the assets can be held until that beneficiary is of a responsible age.

- Ensure privacy: Probate is an open process that’s part of the public record. A living trust guarantees privacy for you and your family after your death. No one can search the public record to learn about your assets or their distribution.

Is a Living Trust Right for Your Estate Planning Measures?

A living trust is a flexible, smart document for any financially savvy adult to have as part of their estate plan, especially for anyone who has complicated investment accounts, extensive assets, multiple homes, or a large family from multiple marriages.

Work with a financial expert at Hollander Lone Maxbauer to determine the best moves to make for your estate to protect your assets now and protect your beneficiaries later. Contact us to schedule a consultation.

The Hollander Lone Maxbauer Article Center

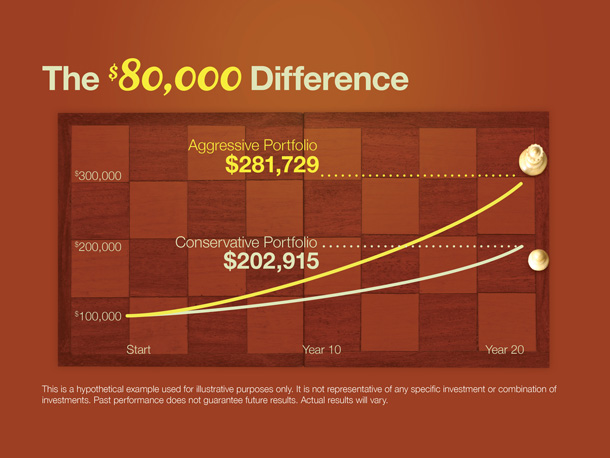

Does Your Portfolio Fit Your Retirement Lifestyle?

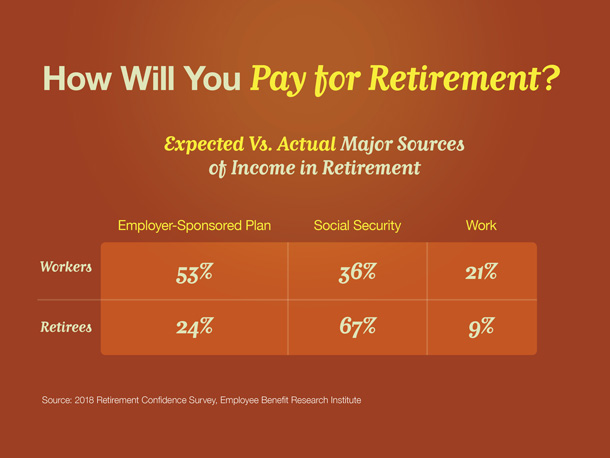

Where Will Your Retirement Money Come From?

9 Facts about Retirement

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

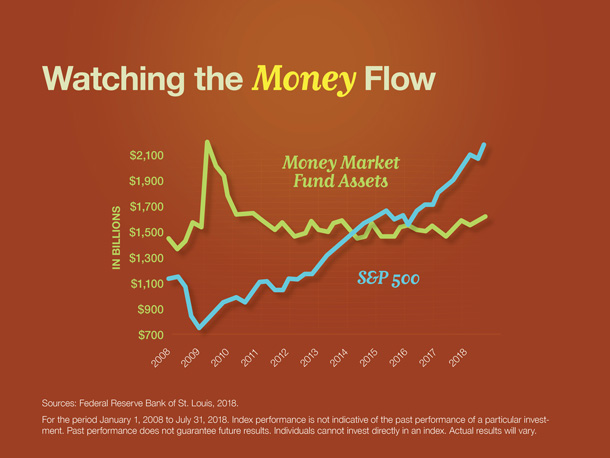

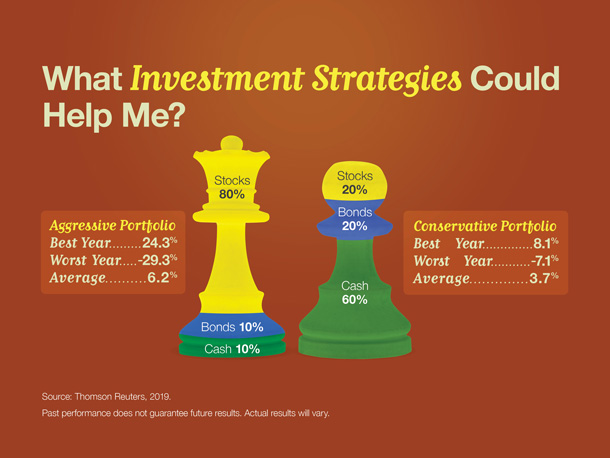

Retirement Matters: Investment Strategies for Retirement