Schedule a Financial Consultation

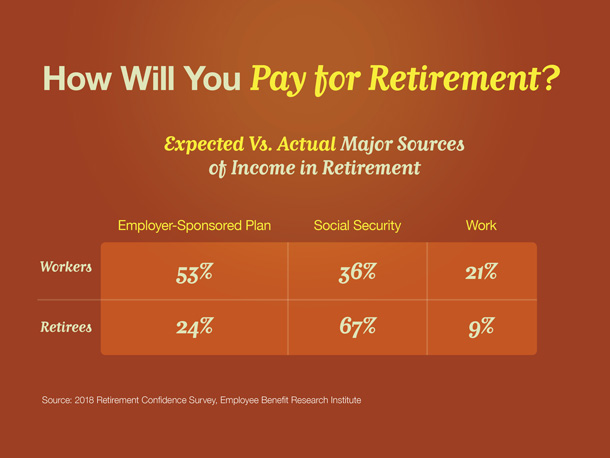

Retirement planning – Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources. Here’s a quick review of the six main sources:

Social Security

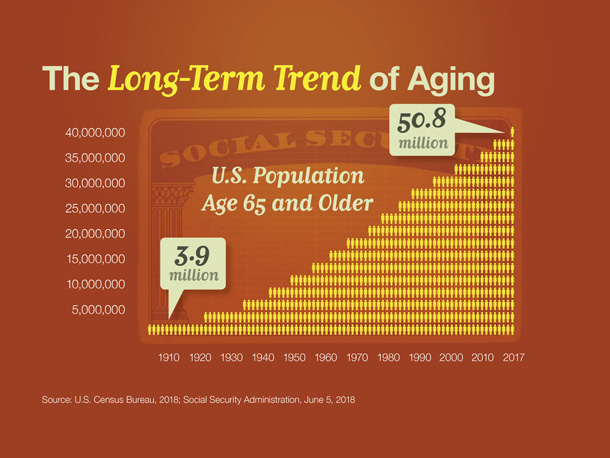

Social Security is the government-administered retirement income program. Workers become eligible after paying Social Security taxes for 10 years. Benefits are based on each worker’s 35 highest earning years. If there are fewer than 35 years of earnings, non-earning years are averaged in as zero.1 In 2021, the average monthly benefit was estimated at $1,543.

Personal Savings

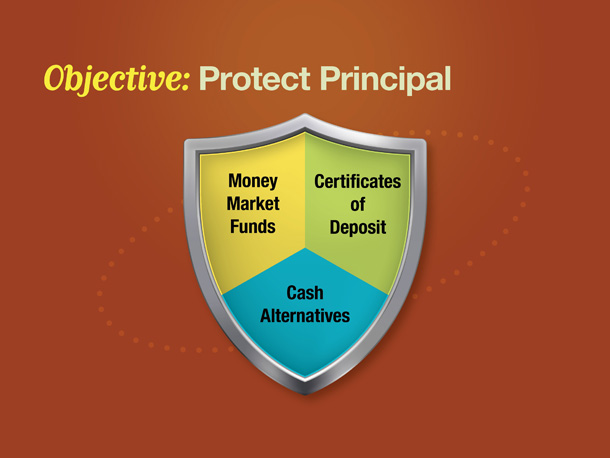

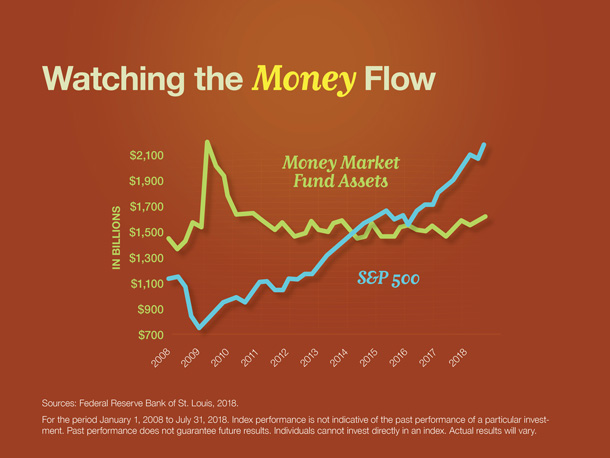

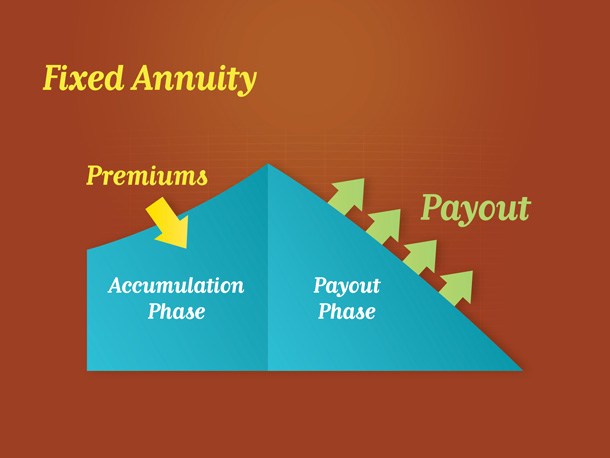

Personal savings and investments outside of retirement plans can provide income during retirement. Retirees often prefer to go for investments that offer monthly guaranteed income over potential returns.

Individual Retirement Account

- Traditional IRAs have been around since 1974. Contributions you make to a traditional IRA may be fully or partially deductible, depending on your individual circumstances.

- Roth IRAs were created in 1997. Roth IRA contributions cannot be made by taxpayers with high incomes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½.

Defined Contribution Plans 401k

Many workers are eligible to participate in a defined-contribution plan such as a 401(k), 403(b), or 457 plan. Eligible workers can set aside a portion of their pre-tax income into an account, which then accumulates, tax deferred.

Defined Benefit Plans Pension

Defined benefit plans are “traditional” pensions—employer–sponsored plans under which benefits, rather than contributions, are defined. Benefits are normally based on factors such as salary history and duration of employment.

Continued Employment

In a recent survey, 71% of workers stated that they planned to keep working in retirement. In contrast, only 31% of retirees reported that continued employment was a major or minor source of retirement income.

The Hollander Lone Maxbauer Article Center

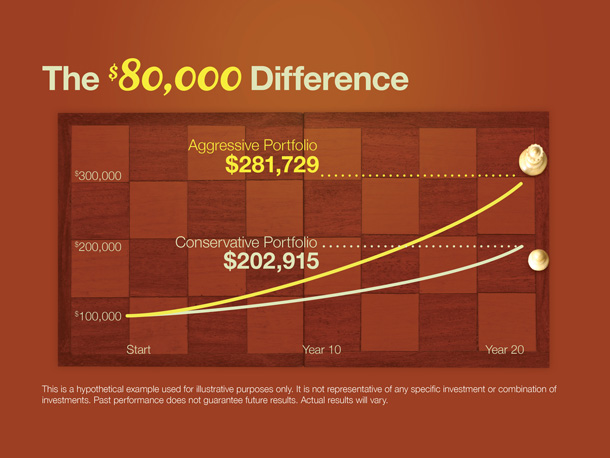

Does Your Portfolio Fit Your Retirement Lifestyle?

Where Will Your Retirement Money Come From?

9 Facts about Retirement

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

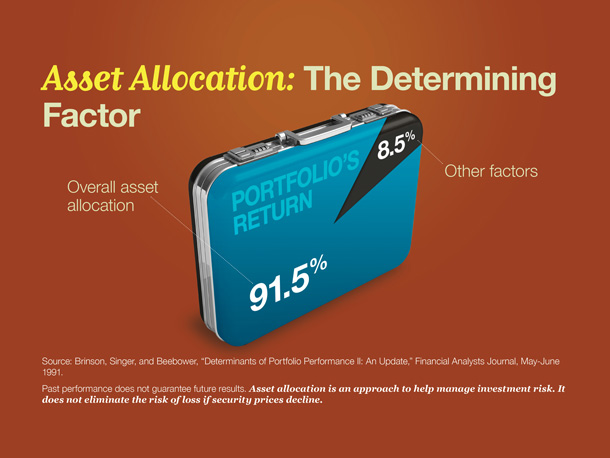

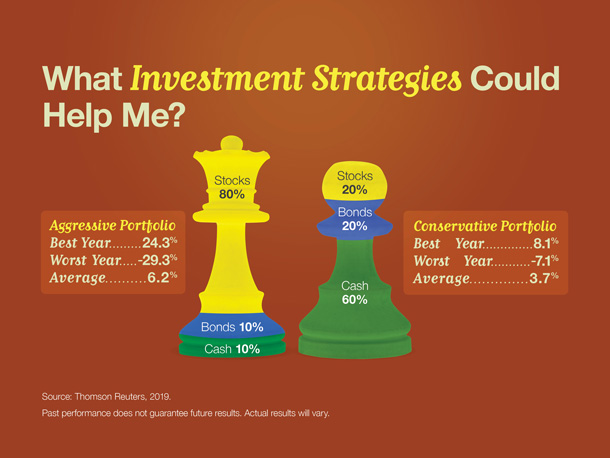

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Retirement Matters: Investment Strategies for Retirement