Schedule a Financial Consultation

Tax planning is an integral part of estate planning. As you determine how you want your assets to be distributed after your death, your financial advisors at Hollander Lone Maxbauer in Southfield, MI, will guide you in the best ways to minimize taxes for your loved ones and create a comfortable financial cushion that simplifies estate management.

Tax Planning Advantages for Estate Planning

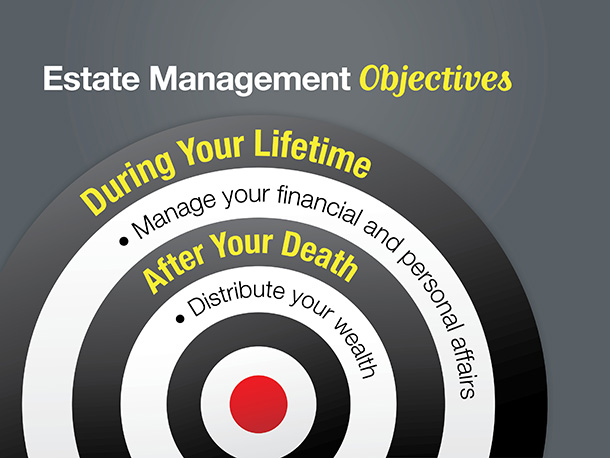

Estate planning is about the future – what’s left behind once you are gone. But estate planning is also about the present – the decisions that should be made now that will benefit your estate as it ages.

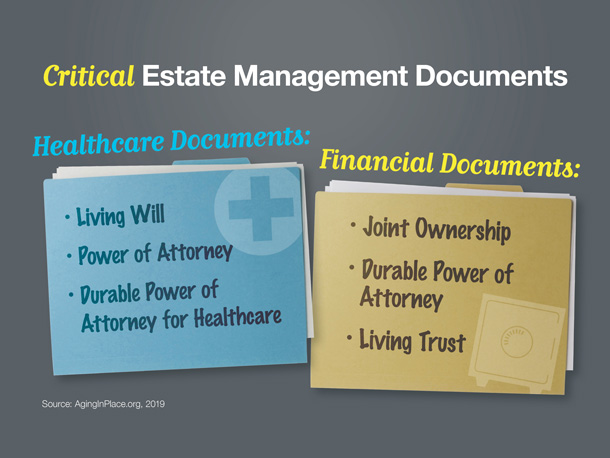

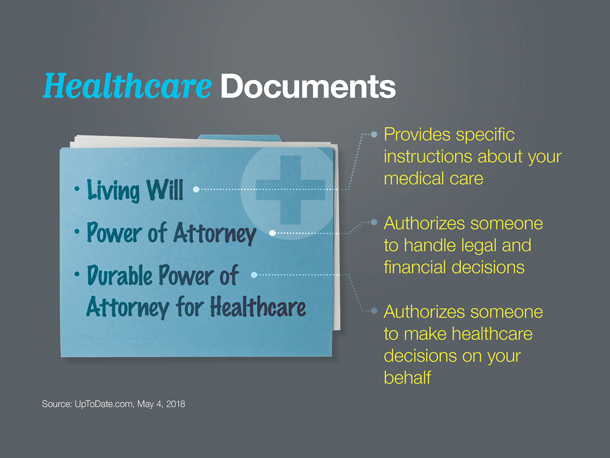

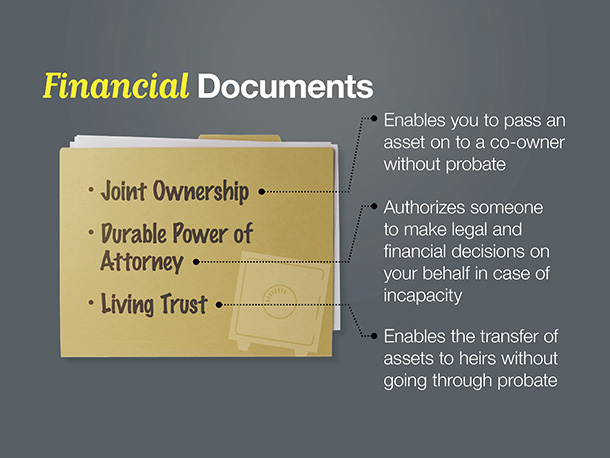

Through careful financial advising, you will learn about exemption limits, be alerted to changes in exemptions as they arise, and be encouraged to consider all possible tax planning advantages. Some of the most common documents to include in estate planning that benefit tax planning include:

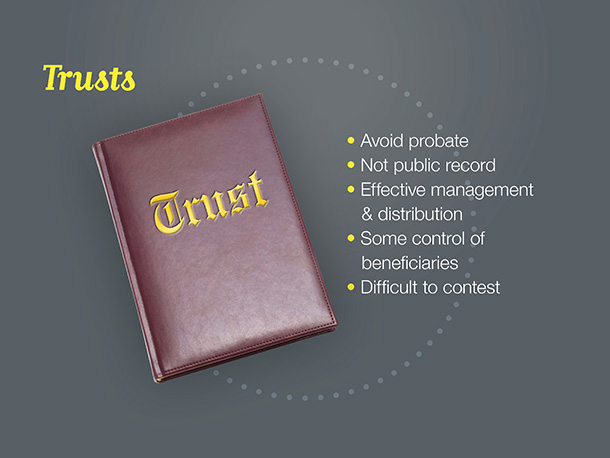

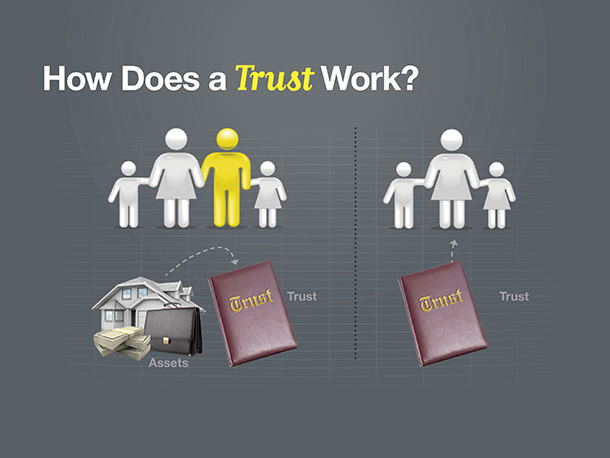

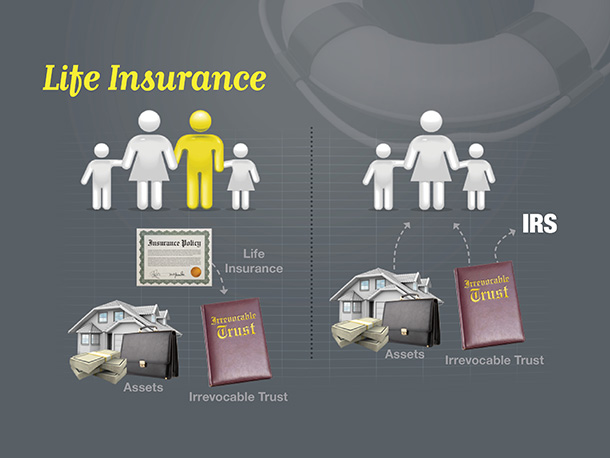

- Irrevocable trust: Through an irrevocable trust, assets can be moved out of your taxable estate and reduce future tax liability. The estate tax burdened can be minimized with the movement of highly appreciated assets out of the estate or by covering any income tax owed on assets in the trust every day.

- Charitable bequests: Donating part of an estate can reduce the estate tax burden – and sometimes even eliminate it – because a charitable bequest is typically denoted as a deduction when the value of the taxable estate is calculated.

- Trusteed IRA: All the tax advantages that exist in a 401(k)and other retirement assets can be preserved by integrating them into a wealth transfer plan such as a trusteed IRA.

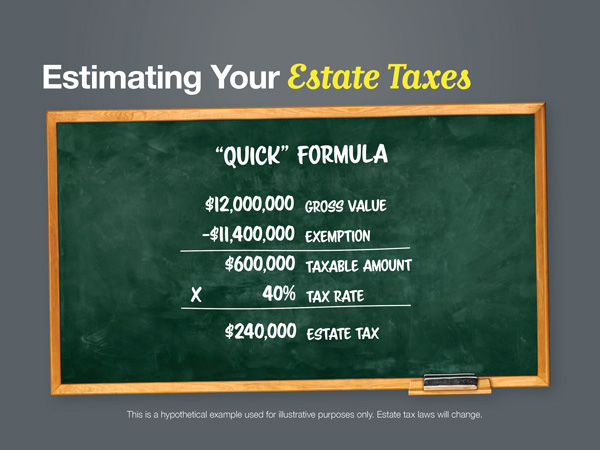

- Gift tax exemptions: There is a lifetime estate exemption for every individual that identifies part of the assets given away during your life or after your death and earmarks them as safe from being subject to taxes.

- Donations: Generosity is the easiest way to remove assets from a taxable estate. Making annual gifts to 501(c)3 organizations, for example, shrinks the taxable estate significantly. Through choices like this, individuals can witness the good their assets do while they’re alive, rather than holding onto resources and only having them disbursed to those in need after death.

Types of Taxes Applied to Estates

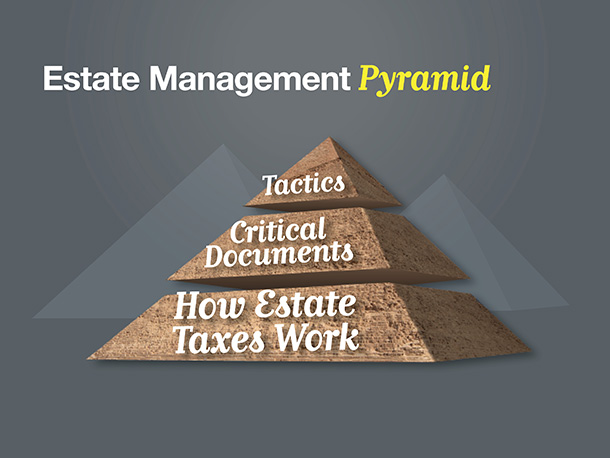

A financial advisor is one of the best resources for estate planning. They explain the monetary demands applied to beneficiaries, executors, and other people who inherit wealth – and help you understand the types of taxes that will be applied to your estate, so you can make the best choices.

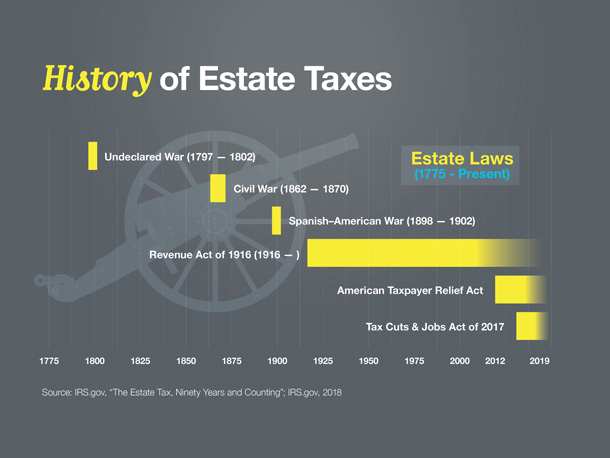

Transfer taxes are typically imposed on an estate at the federal and state levels and can include federal estate tax, federal gift tax, state inheritance tax, and federal generation-skipping transfer tax. When you have a clearly delineated estate plan, the transfer of wealth and fulfillment of philanthropic goals will only feel a minimal tax liability.

The most important thing you can do regarding the taxes that may or may not be applied to your estate is learn about all available tax planning options, select the most tax-friendly for your estate, and become fully educated in your entire wealth transfer plan, with help from an experienced financial advisor.

Manage Tax Planning for Your Estate in Southfield

Estate planning can be confusing. Rolling tax planning into these monumental decisions complicates matters further. With the support of Hollander Lone Maxbauer, your investment choices and estate choices will be sound and minimize the eventual tax liability of your estate.

Ensure that the assets you have accumulated throughout your life are disbursed as you see fit after your death, and taxes applied to your estate when it is disbursed are mitigated as much as possible. Schedule an appointment with one of our financial consultants.

The Hollander Lone Maxbauer Article Center

How Much Life Insurance Do You Need?

Using Trusts to Manage Wealth: What Investors Should Know

Most Common Estate Planning Missteps

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

Estate Matters: Principles of Preserving Wealth