Business Owners & Executives

- Succession planning

- Cash-flow & business liquidity needs

- Integration of individual and business tax planning needs

- Company retirement and benefits programs

- Asset protection strategies & liability management

- Buy-sell agreements

Medical Professionals and Medical Groups

- Transitions from residency to retirement and beyond

- Managing tax burdens

- Loss prevention and asset protection strategies

- Risk management & insurance

- Coordination of benefits

- Working towards multiple savings goals concurrently

- Debt management

- Medical group disability & life

- Custom design, creation, & implementation support of new qualified group retirement plans

- Due diligence reviews of existing plans for DOL & ERISA requirements

Multigenerational Families

- Typically involves three or more generations of family and at least one member who wants to pass on their benefits to their spouse, children, or grandchildren

- Layered financial planning that involves educated choices about assets

- Earmarked finances for college, elder care, and charitable donations using money, property, and investments

- Coordination of the passing down of generational wealth through estate planning and a will, trusts, foundations, or account beneficiaries

- Financial planning through investments, insurance options, and education

- Proactive measures to secure wealth perpetuation and minimize risks

- Maximizing philanthropy or charitable giving

- Creation of a strategy for personal objectives driven by liquidity needs and family’s risk tolerance

Retirees

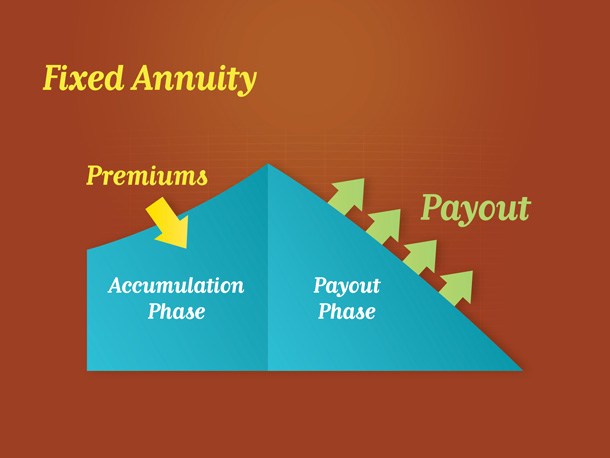

- Coordination of dispersal of funds from different savings vehicles for tax efficiency

- Strategic organization of distributions aimed at optimizing taxes, growth, and income in retirement

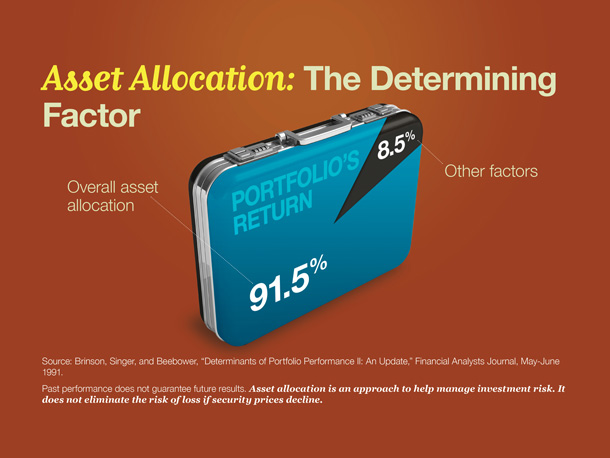

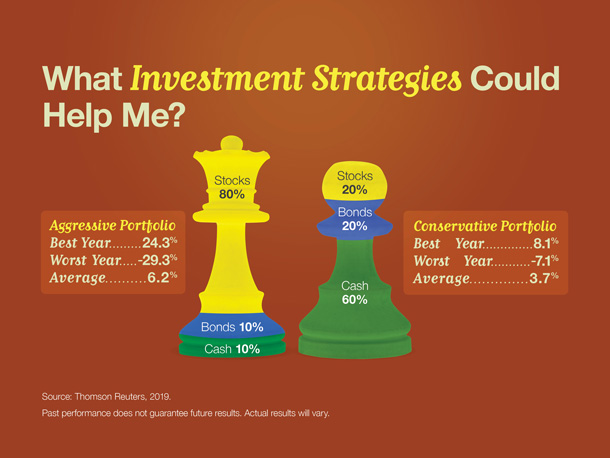

- Asset allocation and regular evaluation during retirement years

- Integration of Social Security & Medicare to maximize available benefits

- Legacy planning & charitable giving

Young Professionals

- Support in setting short-term and long-term goals

- Improvement of financial literacy

- Guidance for expendable income, home ownership, and savings accounts

- Making investments for the present and future

- Prepare for retirement, unemployment, and illness

- Identifying the best ways to merge finances with a partner when marrying, moving in together, or starting a business together

- Unravel the intricacies of employee benefits to understand the best decisions for you

- Financial guidance in saving for a child’s education, improving credit score, investing, and debt reduction

Schedule a Financial Consultation

The Hollander Lone Maxbauer Article Center

Does Your Portfolio Fit Your Retirement Lifestyle?

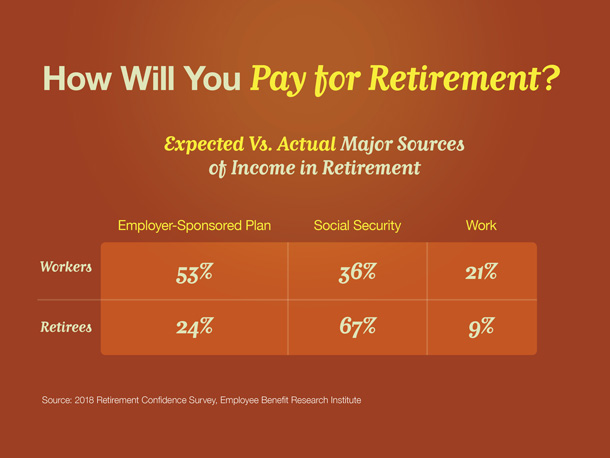

Where Will Your Retirement Money Come From?

9 Facts about Retirement

Our Process

Discover

We want to know you! What makes you tick? Your goals and dreams, career and financial history, cash-flow, tax considerations, and family & estate planning. We also want to know about your relationship with money and what you really value in life. What motivates and interests you and what your vision of financial freedom is.

Recommend

We build a comprehensive summary and a plan of action. Considering many “what-if” scenarios and potential outcomes, we determine together an appropriate blueprint and strategies for addressing your ongoing objectives.

Implement

Execution is continuous, but in the first 90 days we’ll build the financial foundation. We’ll load and customize your personal financial dashboard, begin coordinating assets and liabilities from all sources, consider wealth protection and tax strategies, and construct your portfolio to give you a total snapshot of your finances in real time – accessible 24/7.

Support

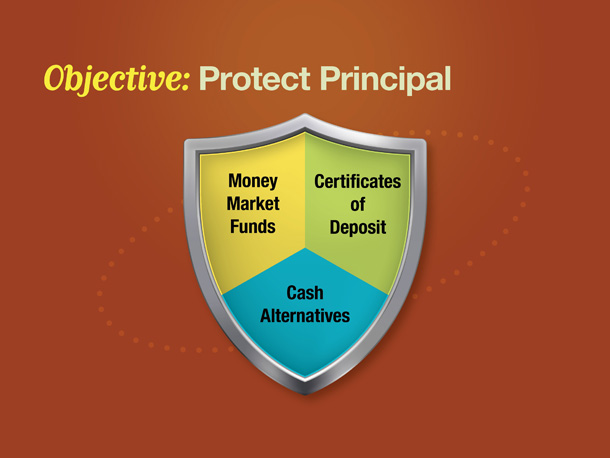

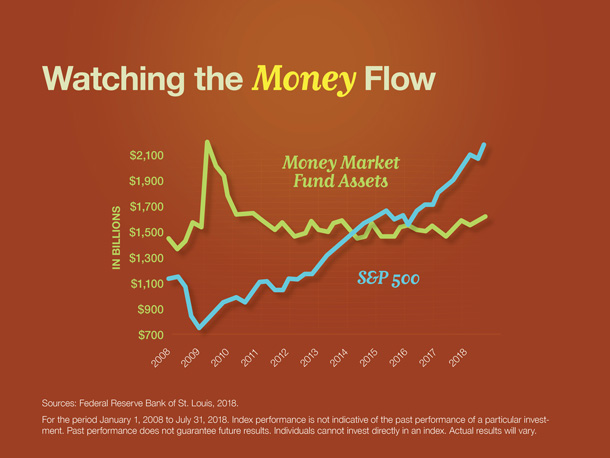

Retirement Matters: Investment Strategies for Retirement