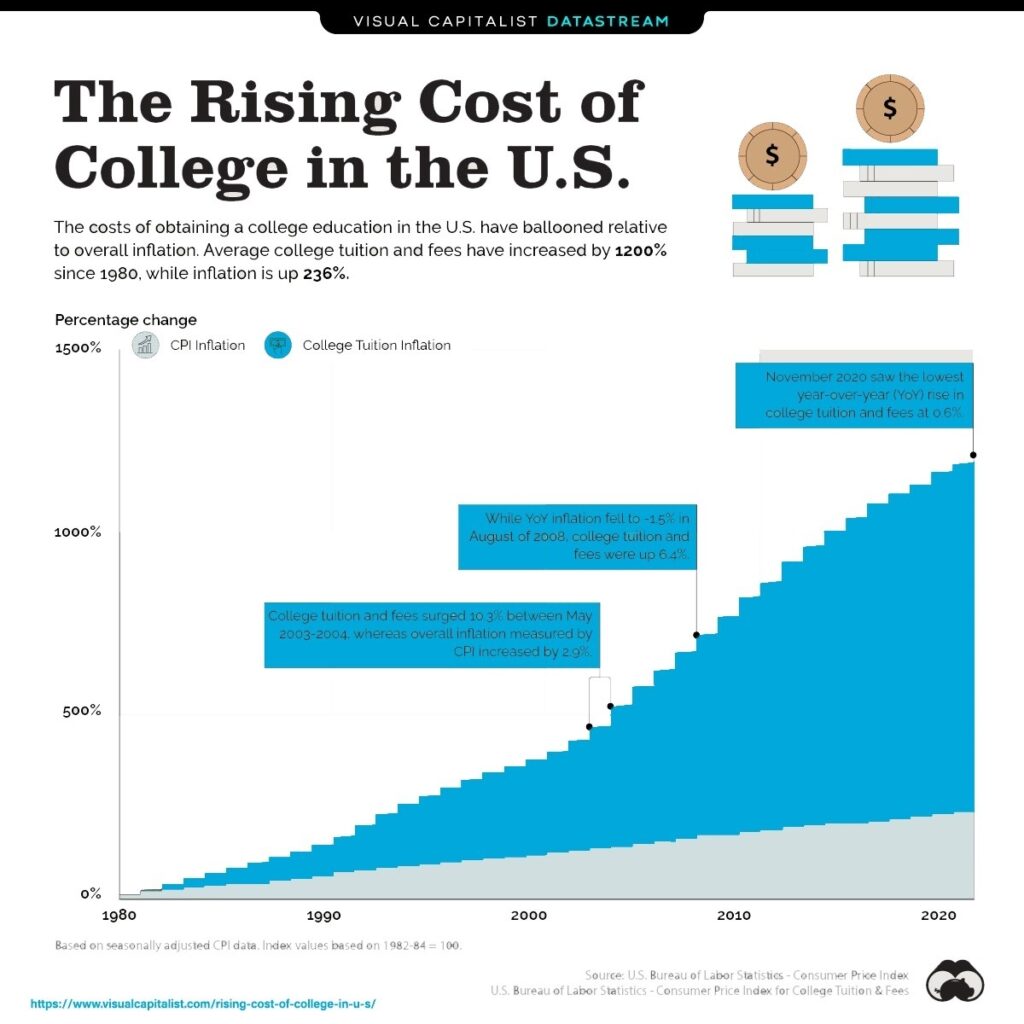

Due to the shift to online classes over the past year, 2020 saw the lowest tuition increase in the last four decades. According to the Bureau of Labor Statistics, the highest year-over-year change in college tuition and fees was recorded in June 1982 at 14.2%, while overall inflation was up 6.6% over that same time period. Contrast that with November 2020, which saw the lowest year-over-year change in the average cost of college at 0.6% as colleges shifted to online classes during the pandemic.

But since 1980, the cost of college (tuition and other fees) has risen by 1,200%.

Prior to the popularity of 529 plans, many people saving for their children’s education opted for either a Uniform Gifts to Minors Act (UGMA) account or a Uniform Transfers to Minors Act (UTMA) account, depending on their state of residence. Today, for those looking to reap the tax benefits 529 plans offer, it is possible to fund most 529 plans with assets from an UGMA or UTMA; however, no two 529 plans are alike. Before an investment is made in a particular 529 plan, the rules applicable to that particular plan should be reviewed carefully.

HOW IT WORKS

The adult custodian of an UGMA or UTMA has the right to manage assets in the interest of the minor child, and may choose to transfer money to a 529 plan, provided the minor is named as the beneficiary of the 529 plan. The UGMA or UTMA custodian will be considered the owner of the plan until the child, upon reaching the age of majority (legal adult age, generally 18 or 21, depending on the state), becomes the owner. Until that time, the adult custodian makes investment decisions.

In order to direct or transfer a minor child’s UGMA/UTMA assets into a 529 plan account, a parent or adult custodian would need to open a UGMA/UTMA 529, also known as a custodial 529 account, which specifies a 529 plan account funded with UGMA/UTMA money already owned by a minor child.

It is important to note that an UGMA or UTMA is irrevocable, and if funds are transferred into a 529 plan, when a child reaches the age to become the owner, he or she becomes entitled to make the money management decisions. If funds are not used to pay for qualified education expenses, earnings will be subject to a 10% Federal income tax penalty, as well as ordinary income tax.

CONSIDERATIONS

UTMA fund transfers into 529 plan accounts must be made in cash only, so it may be necessary to sell UGMA/UTMA assets, such as stocks or mutual funds, and capital gains tax may be due. On the other hand, future withdrawals from a 529 plan will not be federally taxed if they are used for qualified higher education expenses, such as eligible tuition, room, and board. But the 529 plan carries the potential risk of a future tax and penalty, if the 529 account funds are used for something other than college.

As you consider investing UGMA/UTMA assets in a 529 plan, familiarize yourself with the pros and cons of different state plans, including your own. Be sure to consult a qualified financial professional to develop an effective strategy to help achieve your long-term financial goals.

Important Disclosures

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

This article was prepared by FMeX.

LPL Tracking # 1-05124547