With everything else going on this year due to COVID-19, it’s been easy to lose track of the latest fallout of the United Kingdom’s (UK) withdrawal from the European Union (EU), also known as Brexit.

The UK is currently in the middle of an 11-month transition period that started on the official Brexit date of January 31, 2020. This period, during which the UK is still following all EU regulations, was designed to give both parties 11 months to finalize the new rules on a host of issues including trade, security, and immigration.

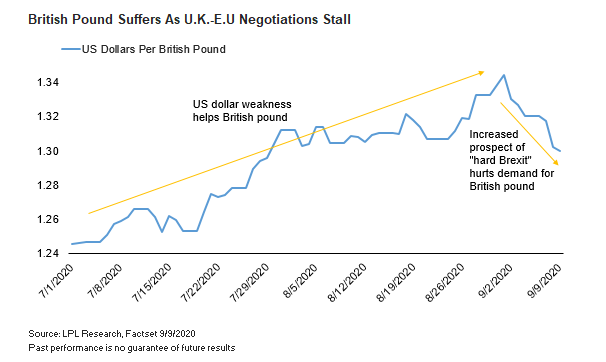

UK-EU negotiations were disrupted by COVID-19 and resumed in July and August, but have not been going well to date. Major sticking points include alignment of workers’ rights and environmental protections, the level of state subsidies allowed (the UK wants to keep the ability to boost tech startups with state aid), and the EU’s access to British fishing waters. Adding to difficulties are current domestic disputes within the UK parliament on the internal trading status of Northern Ireland.

“Given the economic challenges brought about by COVID-19, we think both parties in these negotiations may eventually compromise to avoid any further negative effects,” said LPL Financial Chief Market Strategist Ryan Detrick. “However, no matter the outcome, we expect this be a relatively minor event for global markets as the UK comprises only 4% of global output.”

Two key dates lie ahead:

October 15–16: European Council Meeting

British Prime Minister Boris Johnson has set this EU summit as the unofficial deadline for a free trade agreement to be reached, stating that if both parties cannot come to terms by then, they should “move on” and start to prepare for the end of the transition period with no deal in place.

December 31: End of the Transition Period

The end of the transition period, in theory, is when terms of any new agreement, goes into effect. If there’s no deal, the UK would revert to World Trade Organization rules, including the introduction of trade tariffs, in a potentially economically damaging “hard Brexit.” While the deadline to extend the transition period officially passed on June 30, we believe a further extension, which would take some agreed backtracking from both sides, can’t be completely ruled out given the effects that COVID has had on the UK and EU economies.

As shown in the LPL Chart of the Day, the British pound has been suffering in currency markets in the past week as stalled negotiations has made the prospect of a “hard Brexit” more plausible.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05054080