Recent economic data confirms that the US economy has entered a recession, led by the consumer, which accounts for more than two-thirds of the economy based on gross domestic product (GDP). The consumer spending collapse was evident from March’s personal consumption expenditures data released last Wednesday, which showed a record 7.5% month-over-month drop in consumer outlays.

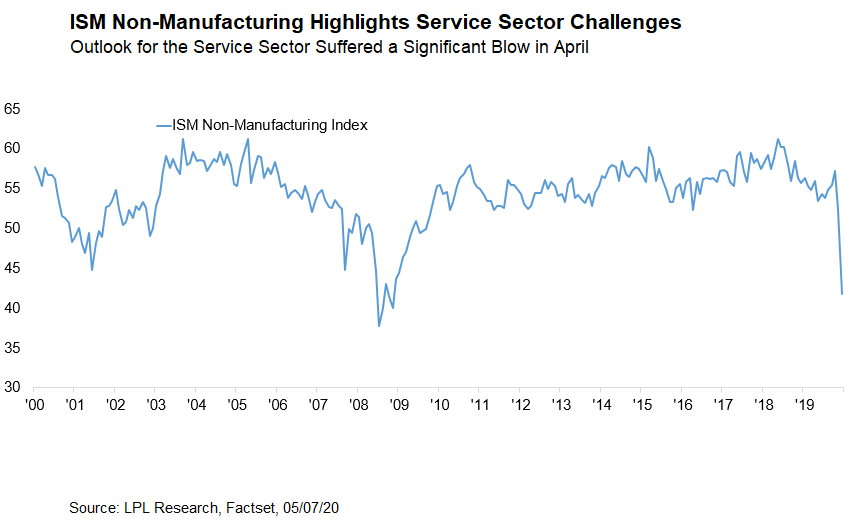

The service sector has also contracted sharply, not surprisingly given the widespread stay-at-home orders and business shutdowns that began in March. Yesterday’s Institute for Supply Management (ISM) Purchasing Manager’s Index (PMI) for non-manufacturing, i.e., services, provided more evidence of the depth of the downturn. As shown in the accompanying chart, the index fell to 41.8 in April, better than Bloomberg’s consensus forecast of 27, but still consistent with prior recessions.

Similar to the manufacturing PMI from last week, this report reveals that the headline number was inflated by the supplier deliveries component. Normally, lengthening supplier delivery times reflect strong demand, which prevents suppliers from keeping up. However, in this environment, it reflects supply chain disruptions from lockdowns around the world related to COVID-19.

As a result, the new orders and employment components, which both fell by almost half to 32.9 and 30, respectively, are better indicators of where the country’s service sector is right now. Both readings have already fallen below 2008-2009 financial crisis lows.

“The recession has been led by the services sector, which has contracted as much as it did in 2008 in a much shorter period of time,” noted LPL Financial Equity Strategist Jeffrey Buchbinder. “We continue to urge caution for those considering investing in service businesses reliant on social contact, including brick-and-mortar retailers, restaurants, hotels, and airlines.”

Looking ahead, while the economic impact of the global lockdowns has been severe, we continue to be reassured by developing plans to reopen the economy, progress toward treatments and vaccines, and the resolve of Americans to get through this. We continue to expect a very strong rebound in the service sector along with the economy later this year.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05007946