On May 27, 2021, a couple of events in the energy sector occurred that demonstrated the continued mainstreaming of sustainable investing and underscored the risks and opportunities available to investors. While primarily thought of as equity-oriented, sustainable investing is becoming more mainstream in fixed income markets—and companies that fail to acknowledge changing dynamics may potentially face financially material impacts.

SUSTAINABLE INVESTING

Sustainable investing is an umbrella term to describe a range of investment practices that seek competitive financial returns and purposefully consider environmental, social, and governance (ESG) risks and opportunities. Approaches such as socially responsible investing (SRI), ESG investing, and impact investing all fall under this umbrella. These three approaches align with investors’ primary motivations for considering sustainable investing – aligning with international norms/values, improving risk-adjusted returns, and providing a positive impact on society.

TRANSITION RISKS

Equity returns in the energy sector have led the S&P 500 Index during 2021 as crude oil prices have soared and, on the surface, seem to show little concern for oil and gas companies’ approach to managing climate risks. However, energy sector bond investors appear to be reevaluating their holdings to get ahead of possible changes. Bond investors, who typically have a longer investment horizon, are increasingly having to consider the financial materiality of climate change.

On May 27, a Dutch court ruled that Royal Dutch Shell PLC needed to slash its carbon emissions 45% by 2030, a move that illustrates the increased pressure from governments to speed up the transition to a low-carbon economy. On the same day, Exxon Mobil Corp. shareholders elected board members who were nominated by a coalition of investors demanding that the company speed up its plans to transition to a low-carbon economy.

Both of these decisions accentuate the changing investment dynamics for how investors look at oil and gas companies. Transition risks resulting from changes in climate and energy policies, a shift to low-carbon technologies, and liability issues may negatively impact the cost of capital for oil and gas companies.

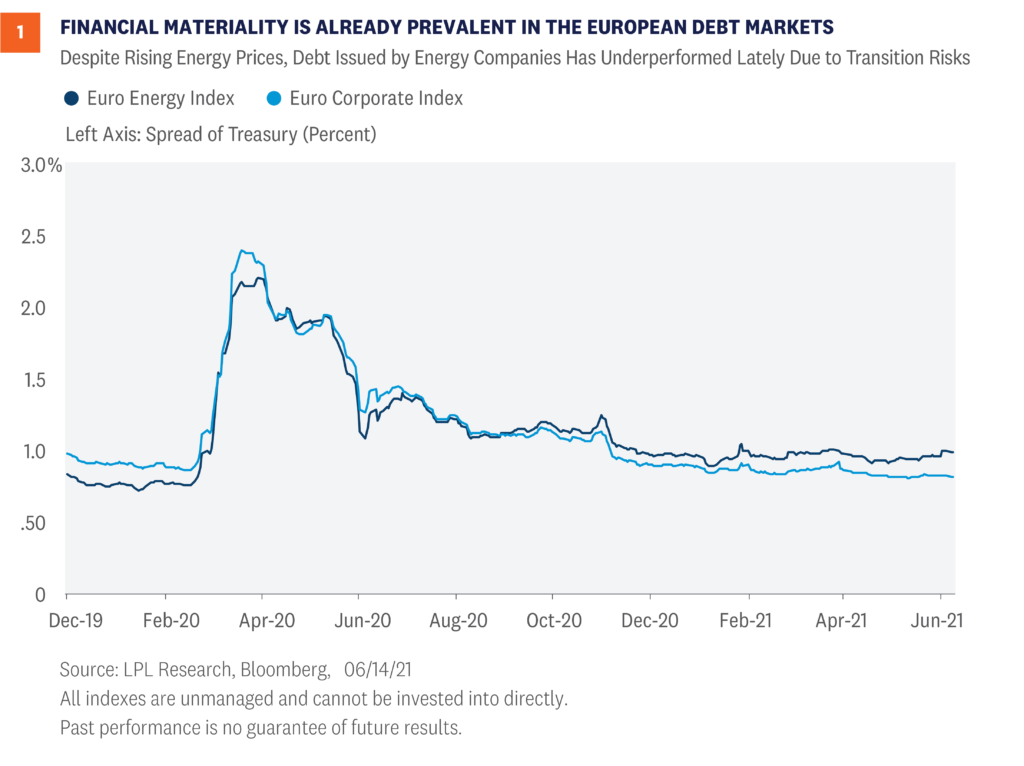

Even as crude oil prices have soared, bonds have lost value. As seen in [Figure 1], Euro-area energy bonds have underperformed Euro-area corporate bonds. Global fixed income credit markets have seen credits spreads, a measure of credit risk, compress this year due to a recovering economy and the continued search for yield. Energy bond sector underperformance is notable and speaks to the financial consequences for companies that are lagging in adjusting to the risks associated with a transition to a low carbon economy.

Moreover, energy companies will likely continue to see their costs to issue debt increase as rating agencies are increasingly incorporating transition risks into their rating decisions. S&P, one of the main bond rating agencies, recently put the oil and gas industry at “moderately high risk,” citing concerns about energy transition risks. Analysis by Bloomberg suggests that approximately $156 billion of North American and European oil debt is at risk of downgrade. Lowered credit ratings generally mean higher capital costs on new and refinanced debt.

OPPORTUNITIES

Many attribute this contrast between the energy equity and bond markets to the positioning of large purchasers of bonds, including central banks, sovereign wealth funds, insurers, and pension funds. For context, during 2020, the European Central Bank (ECB) purchased $105 billion, the Bank of England over $13 billion, and the U.S. Federal Reserve nearly $5 billion of corporate bonds through their stimulus programs. Some central banks have indicated that they would consider their role in reducing carbon emissions when selecting corporate bonds. In March of this year, the Bank of England indicated that it would adjust its corporate bond buying program to account for the climate impact of issuers and discontinue subsidizing polluting industries.

Additionally, other large asset owners such as corporate pension funds, insurance companies, and mutual funds are also increasingly moving assets to debt linked to ESG initiatives. Over 2,300 organizations, representing over USD $80 trillion in assets under management (AUM), have signed the United Nations Principles of Responsible Investing. While certainly not all fixed income related, the sheer size of AUM interested in sustainable investing will impact fixed income markets broadly. As such, the general make-up of debt markets will continue to evolve and, we think, will include a growing share of debt linked to ESG risks and opportunities.

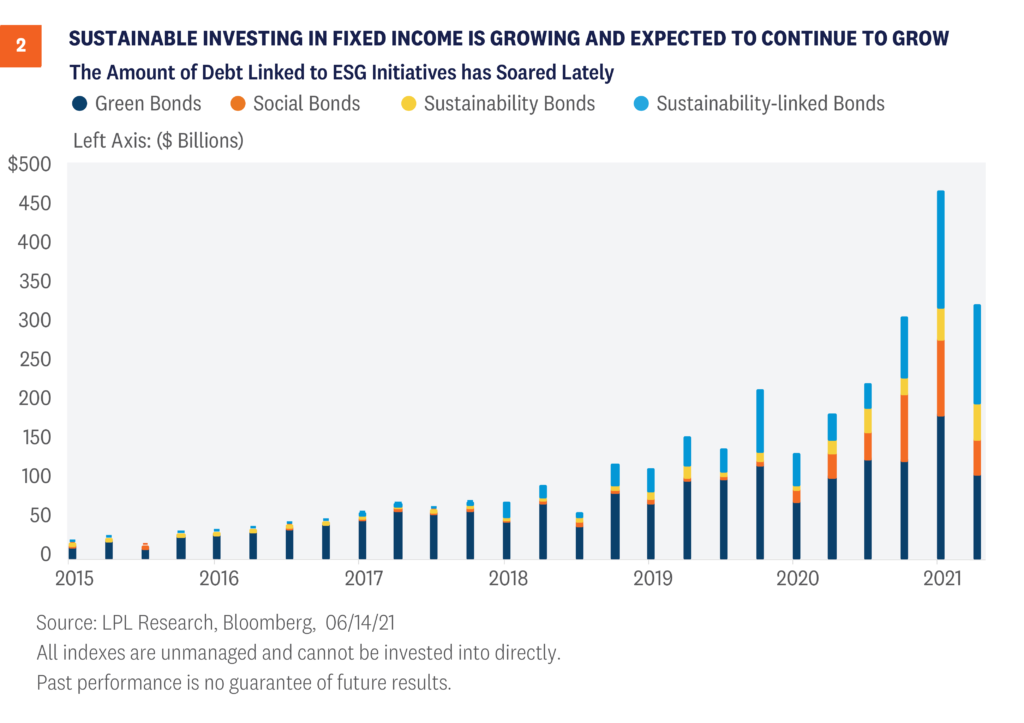

As seen in [Figure 2], the data certainly seems to back up our current thinking. Since 2015, the amount of debt linked to ESG projects has continued to grow. For the entirety of 2015, debt issued to support ESG projects totaled around $80 billion. Now, we’re seeing multiplies of that every quarter! Over $400 billion of ESG related debt was issued in the first quarter of 2021 alone.

Moreover, debt structures continue to evolve. What was once a market denominated by Green Bonds has now evolved into debt that holds companies more accountable for their sustainability efforts. For example, sustainability-linked bonds have coupons that reset based upon certain sustainability performance targets. Meaning, if companies don’t meet their sustainability goals, their debt costs go up (generally by 0.25% a year). Again, these are real costs to companies that fail to uphold their sustainability commitments. That the debt structures continue to evolve allows investors to target issuers with clearly defined goals and objectives, which serves to broaden the appetite for ESG-linked debt.

CONCLUSION

While the evolution of sustainable investing has impacted the equity markets and is often discussed, sustainable investing in the fixed income landscape is changing as well. As providers of capital, fixed income investors play a key role in shaping the future of sustainable investing. Transition risks are real risks to debt issuers, and those borrowers that fail to recognize this changing dynamic are likely to see higher borrowing costs. The appetite for ESG-linked debt continues to grow and, likewise, issuance trends are increasing to satisfy that demand. Moreover, large asset owners, including central banks, sovereign wealth funds, and pension plans, are increasingly incorporating sustainability in their decision-making process, showing that this trend itself is likely sustainable.

Read previous editions of Weekly Market Commentaryon lpl.com at News & Media.

Jason Hoody, CFA, Head of Sustainable Investing, LPL Financial

Lawrence Gillum, CFA, Fixed Income Strategist, LPL Financial

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-785325-0621 | For Public Use | Tracking # 1-05154602 (Exp. 06/22)