The US economy had a tumultuous year in 2020, to say the least, and after rebounding strongly in the third quarter, the holiday surge in COVID-19 cases increased the risk that the economy may stumble heading into the new year. The sharp increase in new COVID-19 cases led to additional curbs on activity to contain the virus, triggering a rise in weekly jobless claims, and many feared we might have a double-dip recession.

Sensing a need to act, Congress passed a fifth relief bill at the end of December, including additional direct payments to households. The lame-duck injection of fiscal stimulus to the US economy was just what it needed. Following a weak retail sales number in December—ordinarily one of the strongest months for retail sales—consumer spending rebounded firmly in January, rising 5.3% month over month according to the US Census Bureau—the most in seven months—and greater than all of the estimates in the Bloomberg economist survey.

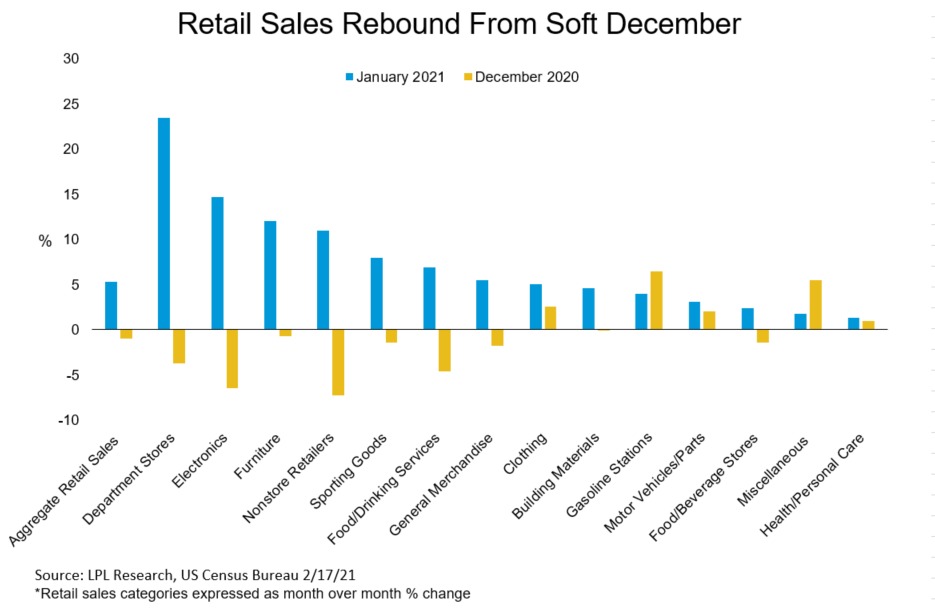

Looking under the hood makes the headline number even more remarkable. As shown in the LPL Chart of the Day, the largest month over month increases came in categories associated with discretionary spending, including a 23.5% surge in spending at department stores:

“Fiscal stimulus was just what the doctor ordered for the US consumer in January,” added LPL Financial Chief Market Strategist Ryan Detrick. “The boom in spending on discretionary categories could become a trend if a wave of pent-up demand gets unleashed on the economy in 2021.”

Clearly, direct payments to households had a major effect on January’s retail sales, so does this mean that February sales will disappoint? Not exactly. Direct payments to households totaled roughly $166 billion, but the increase in January sales was only $29 billion and the savings rate remains high. Of course, not all of that money was spent on retail items, but there may be some gas left in the tank for February retail sales, particularly by individuals who didn’t receive their payments until later in the month or who will be receiving a credit on their federal tax returns.

Earlier this month, we raised our gross domestic product (GDP) forecast for the US from 4–4.5% to 5–5.5%. Yesterday’s retail sales number puts us on a solid path toward achieving that target—and may even raise the prospects of exceeding it. The first quarter of 2021 is expected to be the weakest of the year, so the January surge in retail sales removes much of the risk of the US economy stumbling out of the gates as we begin 2021.

However, a strong start to the year may embolden the call for a smaller price tag for President Biden’s fiscal stimulus proposal. Despite this, we ultimately believe a stimulus package north of $1 trillion is likely, which should prime the US economy for continued growth in 2021 as the battle against COVID-19 improves.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05112902