A charitable lead trust can be a great way for an individual to leverage his or her generosity, producing tax savings that can be used to provide greater benefits to both the individual’s favorite charity and his or her own family. The tax savings are generated because of the way donation values are calculated and because those values become fixed when the trust is created and funded.

What is a charitable lead trust?

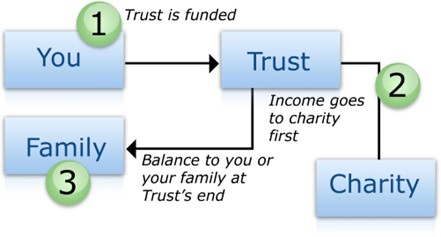

A charitable lead trust (CLT) is essentially a charitable remainder trust in reverse. First, the charity receives an income stream (the income interest), then, at the end of the specified trust term, which can be for a term of years, for the lifetime of the donor, or for the lifetimes of the donor and the donor’s spouse, any income and principal remaining in the CLT (the remainder interest) can either revert back to the donor or pass to other non-charitable beneficiaries named in the trust.

How does a charitable lead trust work?

A CLT can be funded in two ways:

- Inter Vivos — An inter vivos CLT is funded during the grantor’s life.

- Testamentary — A testamentary CLT is funded at the donor’s death through the donor’s will. As long as the CLT is included in the donor’s taxable estate, the estate can deduct the net present value of the income stream granted to the charity. Minimizing estate taxes is the primary motive for funding a CLT at death.

Generally, there are two types of CLTs for income tax purposes:

- Grantor Lead Trust — With this type of CLT, the donor is considered the owner of the CLT assets. All trust income and expenses pass through to the donor on the donor’s personal income tax return, and the donor can take an immediate income tax deduction for the value of the income stream that passes to the charity (subject to limitations). Minimizing income taxes is the primary motive for creating a grantor lead trust. A grantor lead trust must be an inter vivos trust.

- Non-Grantor Lead Trust — This type of CLT is treated as a separate tax-paying entity subject to the income tax rules associated with trusts. All income and expenses are reported on a separate, fiduciary income tax return — they do not flow through the donor, and no income tax deduction is allowed to the donor, although the trust itself can deduct its annual payments to the charity. A non-grantor lead trust can be either inter vivos or testamentary.

If a CLT’s remainder interest does not revert to the donor or the donor’s spouse, but passes to other non-charitable beneficiaries, there will be transfer tax consequences.

- Gift tax — If the remainder interest passes to other non-charitable beneficiaries during the donor’s life, the transfer will be subject to gift tax, but the net present value of the gift can be reduced (discounted) by the value of the income stream granted to the charity. Because the transfer is a gift, the non-charitable beneficiaries will receive a carryover basis in the trust assets.

- Estate tax — If the remainder interest passes to the other non-charitable beneficiaries after the donor’s death, the transfer may be subject to estate tax, but at the date of transfer value. Any appreciation in the trust assets value will be entirely estate tax free. And, if there are payments still owed to the charity at the donor’s death, the donor’s estate can deduct the net present value of those payments. If the transfer is subject to estate tax, the non-charitable beneficiaries will receive trust assets with a step up in basis. If not, they may receive a carryover or modified carryover basis instead.

- Generation-skipping transfer tax (GSTT) — If the remainder beneficiaries are more than one generation below the donor, the transfer may also be subject to generation-skipping transfer tax (which may be offset to the extent of the donor’s available GSTT exemption).

The income stream to the charity can be calculated in one of the following two ways:

- Charitable Lead Annuity Trust (CLAT) — A CLAT pays out a fixed amount each year based on the initial fair market value of the trust assets. Earnings and growth are added to the trust corpus, so each payment represents a smaller percentage of the total trust value.

- Charitable Lead Unitrust (CLUT) — A CLUT revalues trust assets annually and pays out an amount based on a specified percentage of that value. The actual payment from a CLUT varies from year to year.

Suitable clients

You may want to consider establishing a charitable lead trust if you:

- Are currently making significant contributions to a favorite charity

- Seek to make future gifts at a significantly discounted gift tax cost

- Own assets you expect to substantially appreciate in value

- Wish to reduce the value of your estate to help minimize future estate tax liabilities faced by your children

- Do not need the income from the assets being donated

Example #1 — Non-Grantor Lead Annuity Trust

John, who often donates to charity, owns substantial property and wants his children, who are now young, to inherit as much of his property as possible when he dies. John creates a non-grantor annuity trust as follows:

- Trust’s Term: 20 years

- Funding Amount: $2,000,000

- Annuity Payout Rate: 5%

- Section 7520 Rate: 2.0%

- Annual Payment to Charity: $100,000

- Value of Charity’s Interest: $1,635,140

- Remainder Interest to Beneficiaries: $364,860

This example shows that the charity will receive $100,000 annually for 20 years. Assuming the trust’s assets appreciate more than the Section 7520 rate, John’s children will receive an amount in excess of the present value of the remainder interest ($364,860) without any gift or estate tax ramifications.

Tip: When interest rates are low, the lead interest for this type of trust is larger than when interest rates are high, resulting in a larger charitable deduction. Interest rates play a key role when considering this type of trust.

Example #2 — Grantor Lead Annuity Trust

John has recently received a windfall and is very concerned about income taxes. John does not need additional income now, but will need it at retirement. John creates and funds a grantor lead annuity trusts as follows:

- Trust’s Term: 20 years

- Funding Amount: $2,000,000

- Annuity Payout Rate: 5%

- Section 7520 Rate: 2.0%

- Annual Payment to Charity: $100,000

- Charitable Income Tax Deduction: $1,635,140

The charitable income tax deduction is subject to rules that may limit or reduce the amount you can actually claim on your income tax return. This type of trust must be created during your lifetime and include provisions that cause you to be considered its owner for income tax purposes. You will have to report all of the trust’s net taxable income on your personal income tax returns. In addition, any assets reverting back to you become part of your taxable estate, thus potentially increasing future estate tax liabilities.

Tip: The value of the non-charitable beneficiary’s interest is determined by first calculating the value of the charity’s interest. This is done using special IRS tax tables. The charity’s interest is then subtracted from the total trust assets to arrive at the non-charitable beneficiary’s interest. Because the executor of your future estate can deduct the entire present value of the lead interest, this strategy works best in a low interest rate environment.

Advantages

- Enables you to experience the impact of your giving during your lifetime

- Helps to substantially reduce the value of a taxable gift in that the gift is made for a future interest (known as an estate freezing technique)

- Provides a gift and estate tax sanctuary for assets expected to appreciate in value

- Allows you to donate to charity and keep trust assets within the family

- Allows you to postpone the non-charitable beneficiary’s receipt of the trust assets

- Allows you to control the payment method, term of the trust and beneficiaries

- Helps to minimize your taxable estate, thus potentially reducing federal estate tax liabilities

Disadvantages

- No income tax deduction unless you are also the “owner” of the charitable lead trust

- Requires an irrevocable commitment

- Requires the charitable payment to be made each year, regardless of whether there is sufficient trust income available