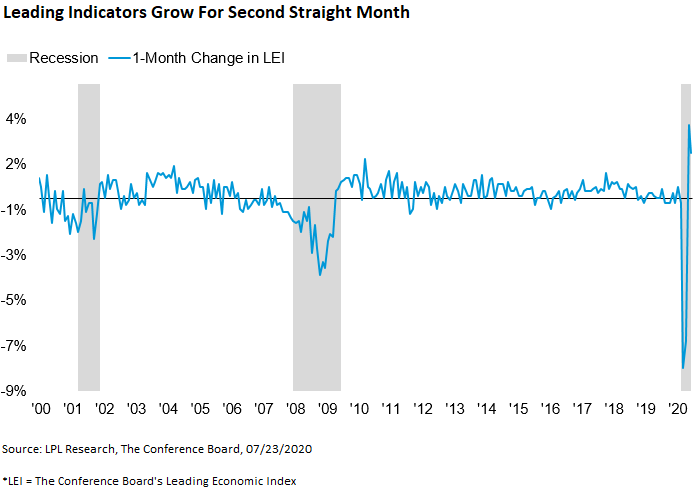

Leading economic indicators continued to rebound in June, albeit at a slightly slower pace than in May.

Yesterday, The Conference Board released its June report detailing the latest reading for its Leading Economic Index (LEI), a composite of data series that tend to lead changes in economic activity. As seen in the LPL Chart of the Day, since the index’s April trough it has posted historically elevated back-to-back monthly increases, rising 2% in June following May’s 3.2% advance. Still, the index has only recovered to an absolute level of 102 compared with January’s all time high of 112.

”Yesterday’s LEI reading confirms our view that a major economic bottom has already formed and that the recovery is underway,” said LPL Financial Chief Market Strategist Ryan Detrick. “But, we are not out of the woods yet. Though we are optimistic, there are still challenges ahead, and we expect a choppier economic march higher in the second leg of this recovery following the initial bounce off the bottom.”

Breadth remained impressive among LEI components, as seven of the 10 subindexes contributed positively. These included average weekly initial claims for unemployment insurance and average weekly manufacturing hours, the two largest positive contributors, which led the way down earlier this year. The three components that detracted were the Leading Credit Index, manufacturers’ new orders for consumer goods and materials, and average consumer expectations for business conditions.

In conjunction with monthly economic data series, we rely on high frequency data to inform our view of the economy’s near-term trajectory and to identify potential inflection points. Many of these series, such as restaurant reservations, public transportation utilization, and new daily virus cases, foreshadowed the recent movements seen in the LEI and other less frequent economic releases. While the overall trends in high frequency data have been positive, recently we have seen evidence that consumers and employers have pulled back some, particularly in areas experiencing COVID-19 flare-ups. But, we remain cautiously optimistic and believe these changes represent bumps in the road in what we still expect to be a broader recovery.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from Factset and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05036844